Another 50 Bitcoin forks in 2018. Madness or reasonable trend

Last month, Bitcoin God appeared. Bitcoin Pizza became available in January. The launch date of Bitcoin Private ... is still kept secret.

And these are just a few examples of the growing family of so-called forks - branches, in which developers copy the Bitcoin software code, releasing it under a new name, with a new token and, sometimes, with new functional features. Often, the authors of such projects seek to benefit from the acclaimed name Bitcoin and make a lot of money on it, even if it is virtual.

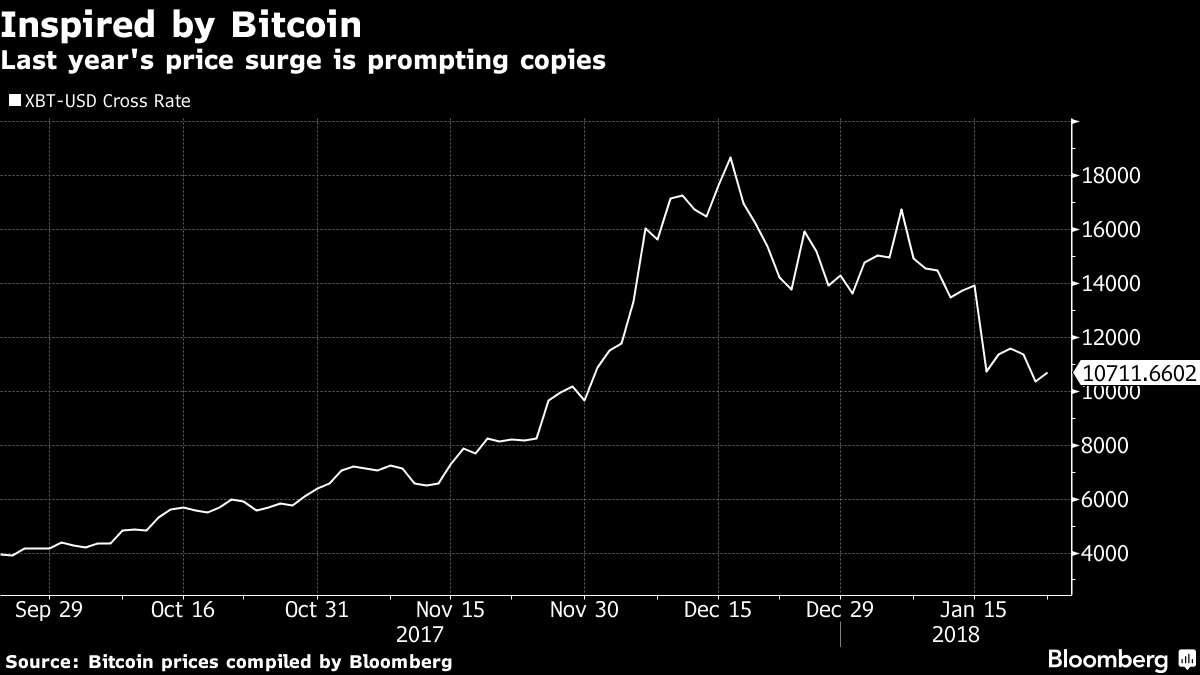

And if last year we witnessed 19 forks, then according to Lex Sokolin , director of fintech strategies at Autonomous Research, this year we will have up to 50 attempts to copy and change code. It is quite possible that this figure is not the limit, since the Forkgen website is already available online, allowing anyone who has the simplest programming skills to launch their own bitcoin clone. Hedge Fund Manager BlockTower Capital Erie Paul, in his tweet on January 14, predicted that more than 10% of the current value of Bitcoin and Bitcoin Cash will settle in their new “offspring”.

At the heart of such initiatives are a variety of motives. Some enthusiasts want to improve the performance of the original cryptocurrency. Others are just looking for quick enrichment. Developers tend to quickly accumulate some stock of newly issued digital coins by participating in their mining immediately after the launch of the network (the so-called post-mining). However, the high cost of new tokens may not last long.

“Unfortunately, most of the forked projects observed today are more likely blatant attempts to“ grab money, ”says George Kimionis, CEO of Coinomi wallet, which allows Bitcoin owners to receive new forks tokens. “In a few years, we will remember this time, and probably we will call them mutations that appeared with the assistance of investors blinded by lust for profit, and not honest attempts to make a contribution to the blockchain ecosystem.”

According to Kimionis' forecasts, forking may soon push to the background the now more popular alternative called ICO, in which startups raise funds by selling completely new tokens. This market experienced a boom last year: in 2017, its participants managed to obtain financing worth more than $ 3.7 billion . Today it has grown so much that it is already difficult for small players to compete on it.

The main advantage of any fork is the name of its predecessor - the world's most famous cryptocurrency. As a rule, such forks give everyone who had bitcoins at the time of launch the opportunity to receive an equivalent amount of new coins. This allows the freshly baked cryptocurrency to instantly gain access to a huge user base. Most Coin immediately have a more or less recognizable name, since it already has the word Bitcoin. As an example, Bitcoin Diamond, the price of which initially went up, but this growth did not last long.

“Bitcoin forks are something like a new kind of altcoins,” says Reth Creighton, one of the authors of the upcoming fork of Bitcoin Private, shares her opinion. “In the near future, we will see other bitcoin forks that will win their places in the first hundred altcoins.” Bitcoin Private promises to provide greater transaction privacy protection compared to the original Bitcoin.

According to Susan Etis, Director of WinterGreen Research, Forks can also help start-ups raise funds in countries such as China, which have a ban on holding an ICO.

Billions of market value

A few years ago, entrepreneurs used Bitcoin code to launch alternative cryptocurrencies, such as Litecoin and Dogecoin, which appeared later, in an effort to create something new, not only in terms of names, but often in terms of functionality. However, Dogecoin, whose market value now stands at $ 744 billion, pales in comparison with younger clones like Bitcoin Cash and Bitcoin Gold. Launched in August, Bitcoin Cash is now in fourth place on the list of the most expensive cryptocurrencies. According to CoinMarketCap.com, its market value is estimated at $ 27 billion.

“Bitcoin Cash managed to achieve very good results and quickly grow,” shared his opinion Charlie Heiter, director of research firm CryptoCompare. “Now the rest of the traders are closely watching the rest of the forks, expecting similar growth from them.”

Fork can often bring millions of dollars in profits to both its developers and server farms supporting the operation of a new network. Bitcoin Gold allocated 100 thousand tokens, the cost of which is now estimated at more than $ 190, to create a fund for financing its own ecosystem and development. About 5 thousand koins went to the accounts of the team of developers who worked on the launch of the fork. If these tokens rise in price, their owners will also receive a solid payoff.

Miners, whose computers and servers handle cryptocurrency transactions, are helping to create new coins in the hope of receiving large rewards. For example, Bitbank and some Chinese miners played an important role when the original Bitcoin developer Jeff Garzik created UnitedBitcoin , the fork of which took place in December. As is often the case with other forks, a new “coin” can be mined on old equipment that can no longer compete with the most modern machines operating on the Bitcoin network. Therefore, if UnitedBitcoin takes off, owners of old miners who decide to support it will be able to participate in the issuance of this digital currency.

Ordinary miners

Many of the new forks are seeking to attract small and individual miners driven out of competition by industrial server farms. Some forks allow mining with the help of graphic processors, which makes participation in the process possible for all owners of graphic cards.

“This is something like a mining installation in a garage,” says Nick Dooley, a member of the Bitcoin Interest development team. “Everyone has video cards, and most people can afford to buy a video card that can mine few coins.”

Even some of the forks themselves become the basis for new forks. For example, the Bitcoin Cash network is about to be used as the basis for launching a new fork called Bitcoin Candy .

Support from the miners is not always enough to keep the price at the right level. According to one of the developers of the fork SegWit2x, which occurred in late December, the new network managed to attract more than 10 thousand miners. However, now prices for B2X are rapidly going down, having already lost more than 90% of their December value.

“We give our users a choice, letting them decide for themselves which assets they would like to use and which they don’t,” says Kimionis from Coinomi. “We do not make decisions for them.”

Source: https://habr.com/ru/post/409711/