Hashflare Yield Review. My experience for 6 months

In this article I want to share with you my experience with the Hashflare cloud mining service .

I will not describe the charms and shortcomings of the service itself, on the Internet there are already written many articles, reviews about it. Surely if you get to this post - about the service you already have some idea and rather are looking for real numbers about it. Well, I have them.

I have been using the service since June 2017, all this time I have been holding a sign with financial results for it. In this post we will talk about this tablet, I will try to highlight the main aspects and show what the real profitability with Hashflare is.

→ Open Access Table

To read the post, I recommend keeping the table open in another tab.

Well, let's start. The first screen is a historical summary of all algorithms for the entire period. At first glance, it is difficult to read and seem like a hodgepodge, but if you look closely, you can see the ups and downs of various cryptocurrencies and their algorithms. For example, the appearance of ASICs in the DASH world, or the mining boom in Ethereum.

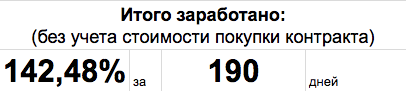

Below there is a detailed breakdown (this is why the graph is being built). Next is a summary of my payback for the entire period. As you can see, I fought back quickly. Here it is worth making an important remark: I keep all the crypt I nominated in Hashflare and do not sell. The percentage of profitability here is calculated as if I had sold everything today at the current rate.

In general, if you plan to make money on a crypt - then one mining is not enough. Either hold the entire crypt for a long time (from six months or more), or try yourself in trading. The weekly / monthly sale of your crypt reduces the payback period of mining at times.

SHA-256

Next, go separately for each coin. SHA-256 is Bitcoin's mining algorithm, currently the most profitable algorithm available. Of the interesting things here, of course, the colossal rise in the rate of Bitcoin, which turned the payback up to heaven, by 500–600% per year.

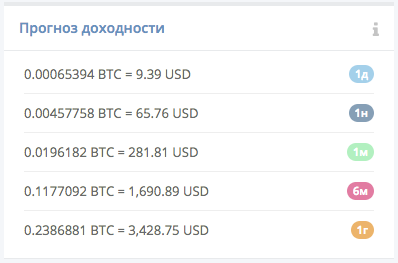

The second important point that I want to draw your attention is the daily commission of Hashflare. On average, it takes 20–30% of your income. Why is it important to count it here? Yes, because in the reports on profitability in Hashflare itself they show the figure without taking into account the commission, that is, it is noticeably overestimated.

Scrypt

The next one is Scrypt, this is the mining algorithm of Litecoin. But Hashflare decided not to bother, and the inked lightcoins convert themselves into bitcoin, and in the bitcoins they pay the reward. For my taste, this is not the most honest moment in their work, because the jumps in the growth of lightcoin on the Scrypt profitability are not particularly correlated. Most recently, light jumped from $ 80 to $ 300 - this jump is visible on the chart. But literally in a couple of days, the yield sharply went down, as if it had been manually twisted. I can not find a logical explanation for this fact.

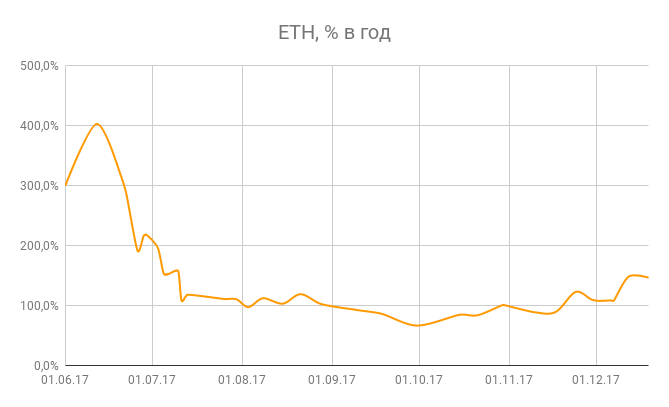

Eth

Next - ETH. When I first bought power in HashFlare, ETH was the most profitable algorithm, with a large margin over all others, this is clearly seen on the general graph. Then there was a boom of GPU mining in Russia and in the world, the complexity of the Ethereum network grew, which naturally affected the profitability. For a long time, she hung around generally below 100% (that is, the purchase price of the contract did not discourage itself). Now, with a new jump in the air, everything looks somewhat better.

In any case, the contract of ETH has long been repulsed and now works as a plus. For all the time, 1.16 coins were minted. At today's rate of $ 1150, this is $ 1335. He spent $ 550 on the purchase of a contract. That is, 206% profit

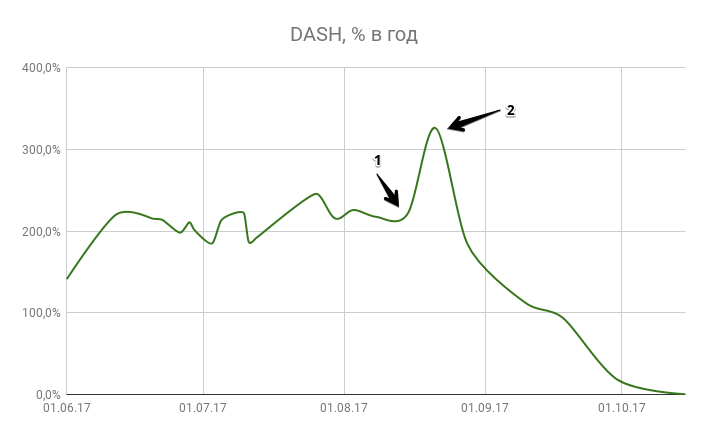

DASH

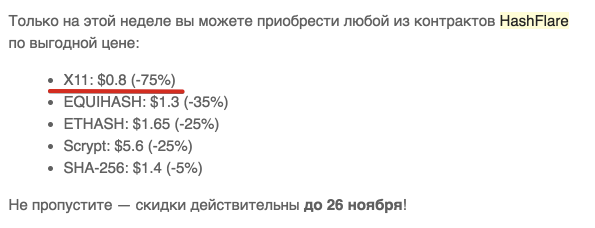

The history of mining DASH finished before it started. The graph clearly shows 2 important historical events. 1 - the news that Bitmain was able to develop an ASIC miner using the X11 (Dash) algorithm, 2 - the first pack of these miners went on sale. With their appearance, the power of the network has increased hundreds of times, thereby killing the cost of previously purchased mega-mixes. Somewhere in early October, the yield reached the level of 0%.

The funny fact is that even when the profitability of the algorithm was already at zero, Hashflare was still selling contracts, at a 75% discount. Not the most honest of them.

However, DASH also managed to completely fight back. In this short time, I managed to mine 0.0958 coins, which at the current rate of $ 1100 costs = $ 105. Let me remind you that buying a contract cost me $ 29. That is, 362% profit

ZEC

The contract was bought only recently, while the statistics have accumulated too little to draw any conclusions. Yield, so far, shows good - about 200%

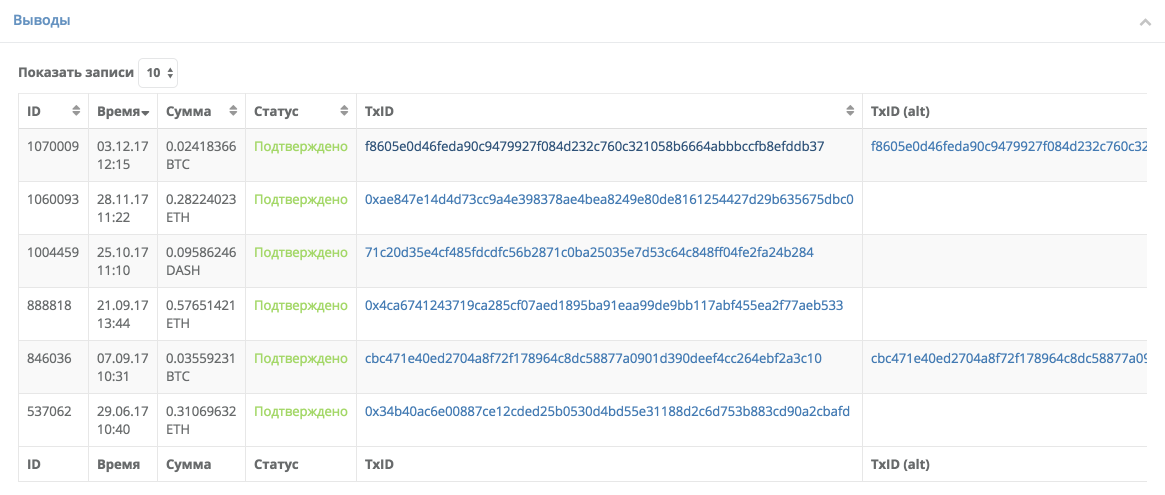

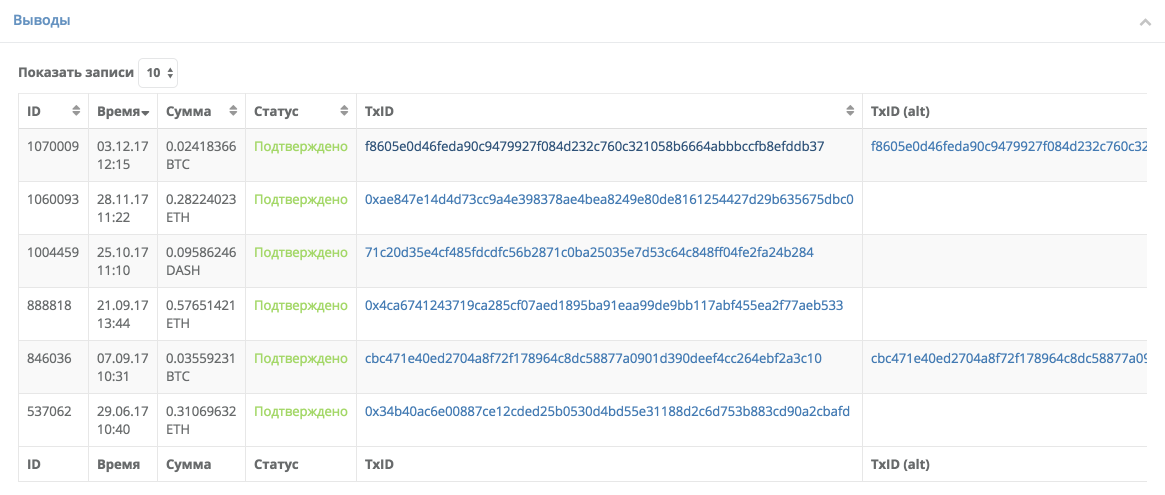

The last tab is Revenue. Here are only coins that I have already brought to my wallets. The last conclusion was 12/19/17. Again, I don’t sell coins, they are all on hold at least until the end of the term of the Hashflare contract. The result for today is 142% of the profit for 190 days.

Conclusion

I do not specifically write any conclusions or conclusions on whether it is necessary to invest in cloud mining, whether it is worth it or if it is a bubble that will burst soon. Everyone will make such a conclusion himself. I hope only that my post will help you with this.

Proofs

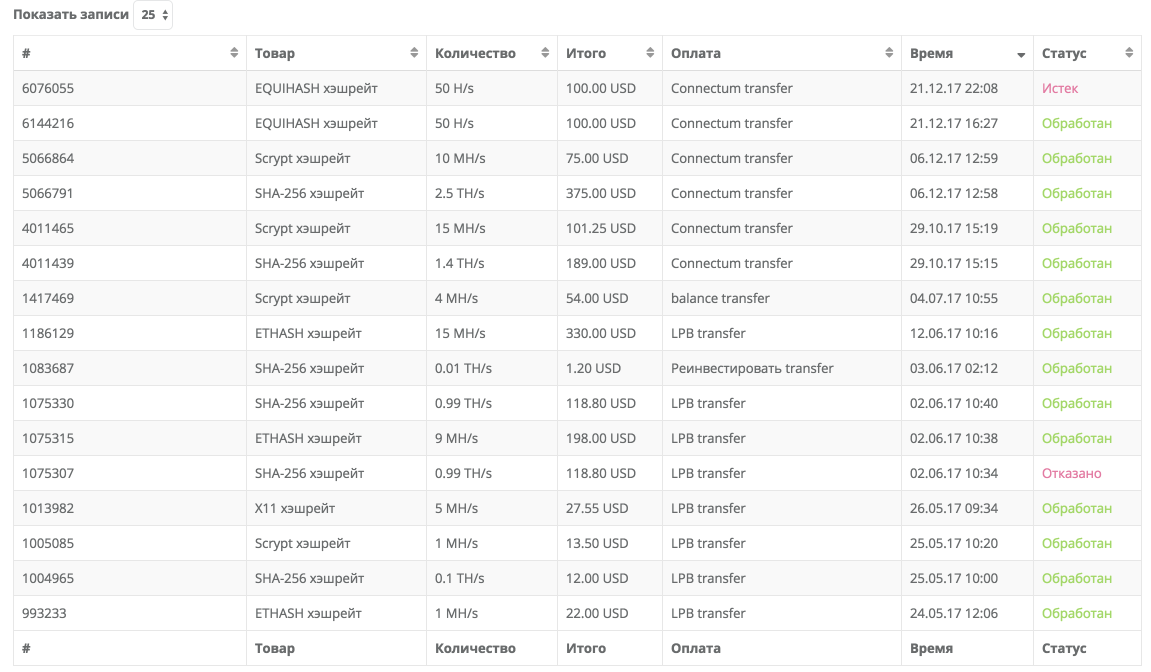

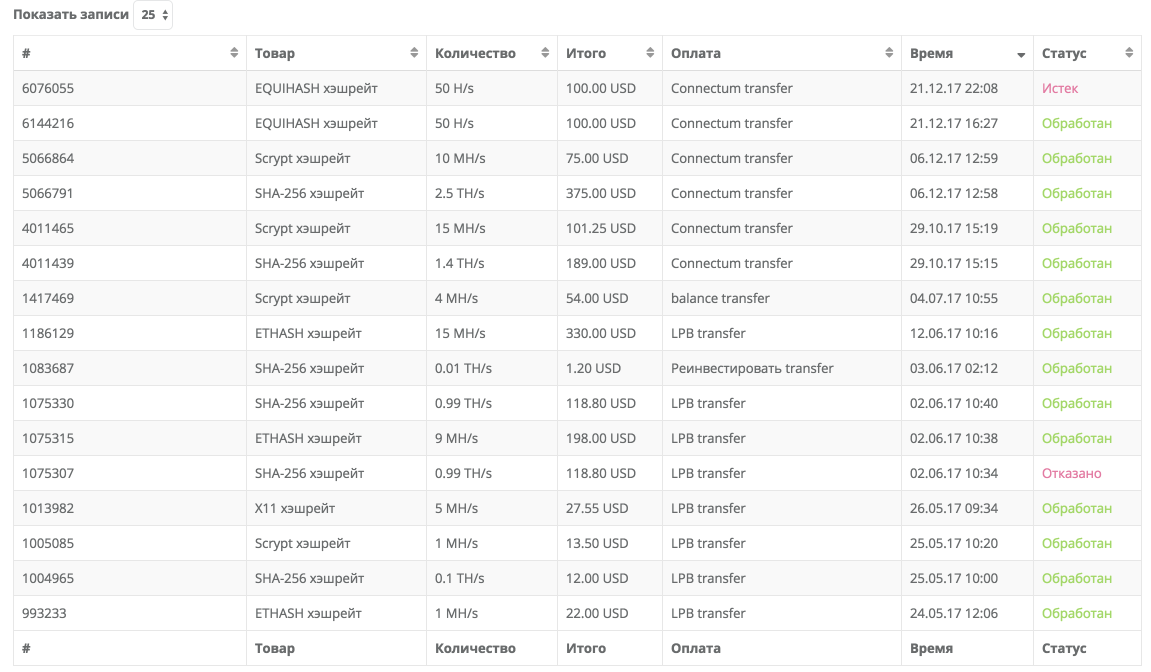

Not to be unfounded, I publish screenshots from my account

Source: https://habr.com/ru/post/409731/