CoinDesk study: only 19% of investors took loans to buy cryptocurrency

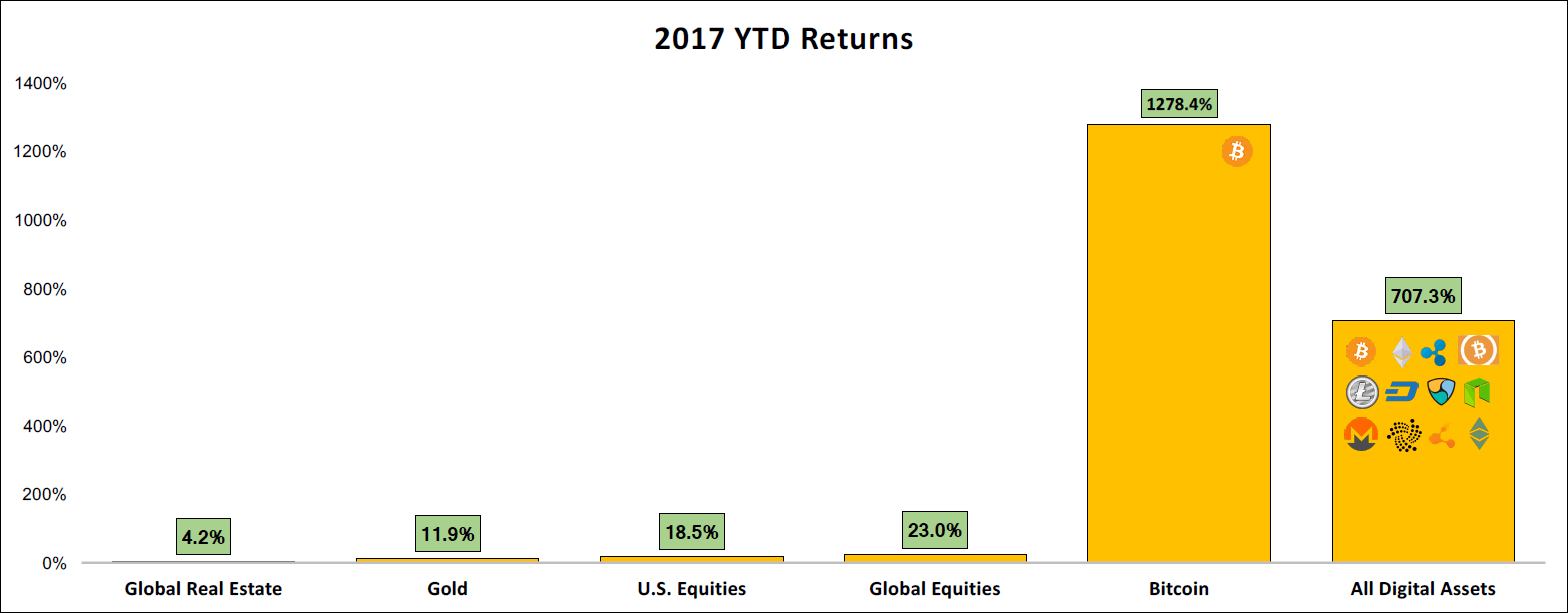

Income from investments in various assets at the end of 2017

CoinDesk has published a large analytical report State of Blockchain 2018 , in which it analyzes the state of the cryptocurrency market in Q4. 2017 provides interesting market statistics for public blockchains, consortium blockchains, distributed registries (DLT), primary coin placements (ICO), trading and investments. It also lists the attempts of governments of different countries to regulate this sector of the new economy.

The authors of the report themselves identify five main themes of recent times.

1. Bubble or not

The growth of Bitcoin in 2017 by 1278% (that is, 13.8 times) forced the experts to once again argue whether it is possible to call Bitcoin “bubble”, that is, an asset with an unreasonably bloated cost. This dilemma also divided CoinDesk readers: in the survey, 49% answered "yes", and 39% answered "no."

Analytical data from the report allows to more reasonably discuss this problem. For example, such a fact: according to a survey, among all cryptoinvestors, only 19% took loans to buy cryptocurrency in the period of its rapid growth.

And of those who took loans, more than half have already returned the debt. This is an important indicator, because in the historical perspective it is known that financial bubbles are pumped to a large extent for borrowed money in the wake of the HYIP. So if bitcoin is considered a bubble, then this is clearly not the kind of bubble that we met in the past, according to the authors of the report from CoinDesk (here it should be noted that CoinDesk is deeply immersed in a business with cryptocurrency, so it does not this survey and the interpretation of its results).

Margin trading with leverage on cryptobirths appeared relatively recently and did not receive special distribution.

2. Market diversification

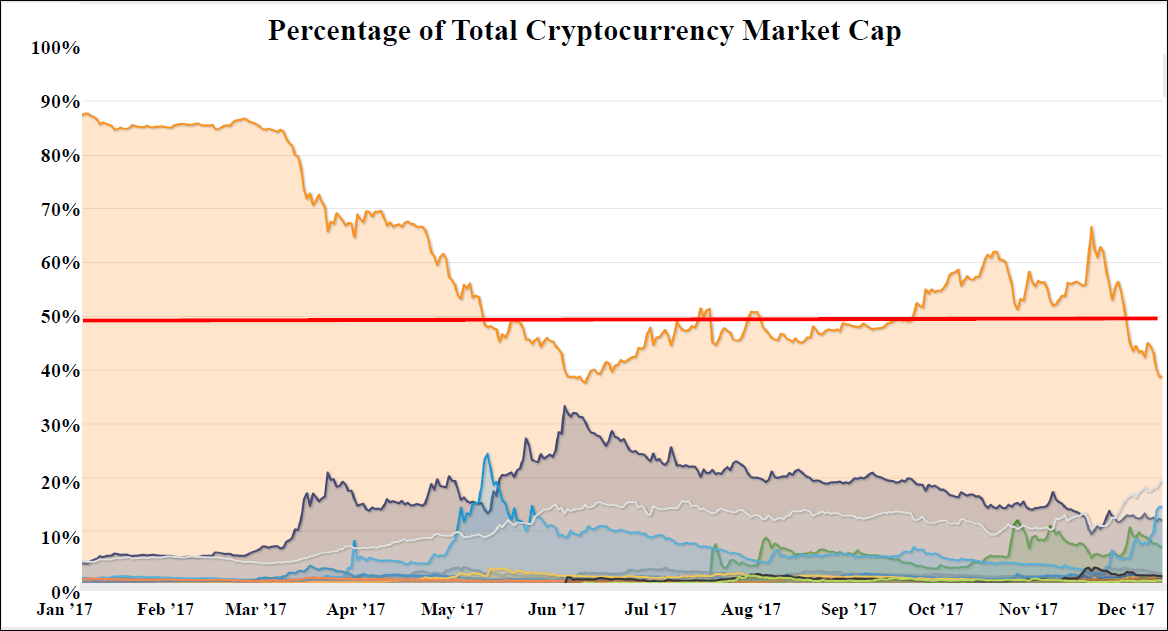

Another important trend is market diversification. In January 2017, Bitcoin capitalization exceeded 90% of the total capitalization of all cryptocurrencies, and Ethereum's share was negligible. But everything changed with the release of "killer features" - smart contracts ERC-20, which allowed to generate tokens and conduct ICO. The demand for broadcasting (usually necessary for participation in the ICO) has risen sharply - and in the third quarter of 2017, Bitcoin dominated.

The end of Bitcoin domination coincided with the activation of the Segregated Witness (SegWit) protocol, which took place on August 24, 2017 in the Bitcoin network.

3. Ethereum Records

The ICO boom stimulated the demand for air in 2017, but not only it. There were other phenomenally popular projects. For example, the December hysteria around the “cryptococcias” of the CryptoKitties - a kind of decentralized Tamagotchi. Although many criticized the stupidity of the game itself, it stimulated additional interest to the general public to the blockchain and the air.

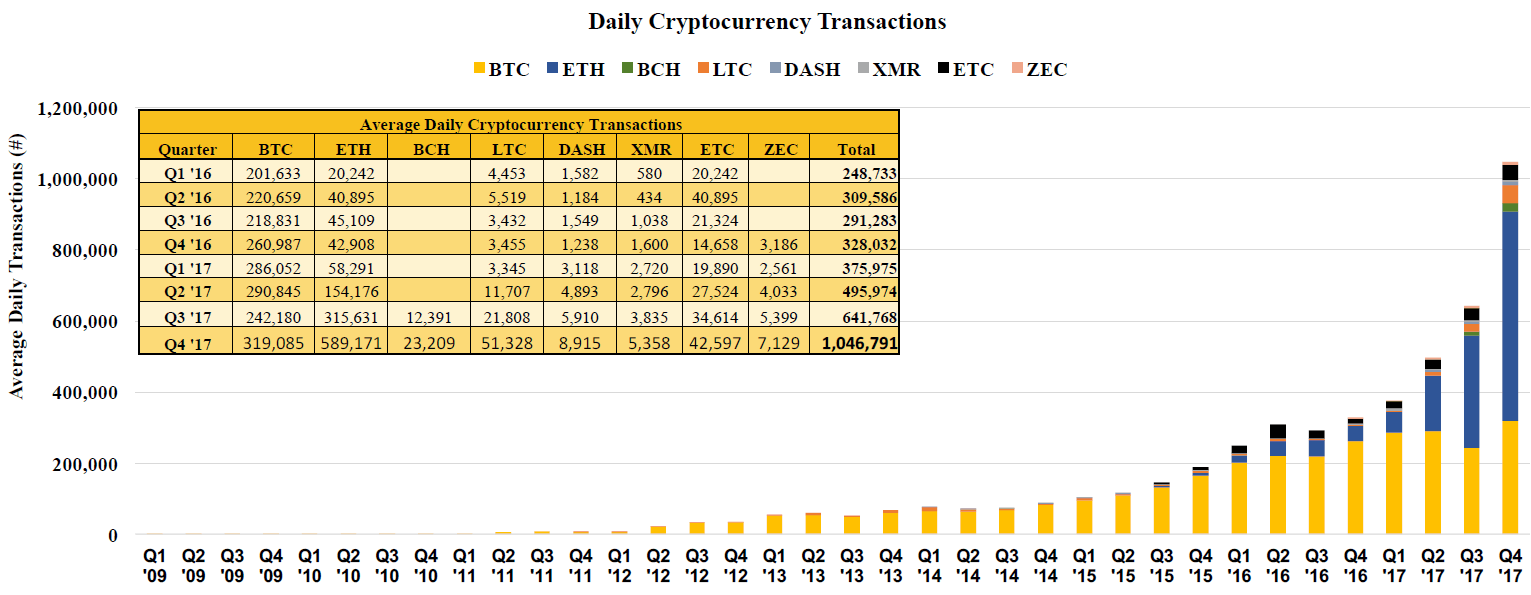

Although in the second and third quarters of Ethereum set absolute records in the number of transactions, in the IV quarter. In 2017, interest in the new game and updates after a hard fork on Byzantium pushed the network to new record achievements - and the number of transactions doubled again a quarter by a quarter. In October-December, the average number of transactions in the Ethereum network was 589,171. For comparison, in the Bitcoin network - 319,085.

Thus, Ethereum retains leadership among all cryptocurrencies in the number of transactions.

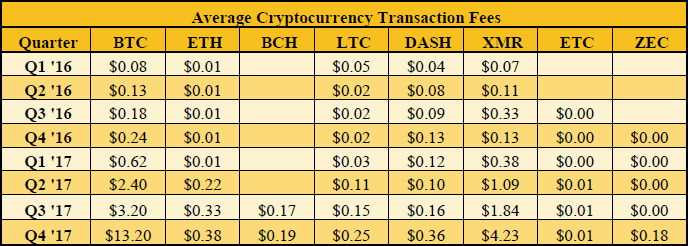

Unfortunately, along with the growth in the number of transactions and the growth of the exchange rate, the average transaction fee in Bitcoin and Etherium networks also increased. In the Bitcoin network at the end of last year, the average commission size jumped to a breathtaking value of $ 13.20 per transaction, although at the beginning of the year it was $ 0.62.

4. Korea took the place of China

Last year in China was marked by government bans. In September, the authorities banned an ICO, and then completely closed all cryptobirds.

However, the market quickly filled the void and was not particularly affected by the closure of the Chinese stock exchanges. Bidding just moved to other platforms, including in South Korea. The course also did not collapse - on the contrary, after the closure of the Chinese stock exchanges, a record rally happened with an almost vertical growth of Bitcoin.

4. Distribution of money

Although in 2017 many large ICOs passed, the main role in raising the overall capitalization of the cryptocurrency market was played not by them, but by forks with free distribution of money to “googlers” (permanent coin holders). The first distribution of coins was carried out by the Bitcoin Cash network: each Bitcoin hodler received a similar number of BCH coins. Example BCH was soon followed by the Stellar system.

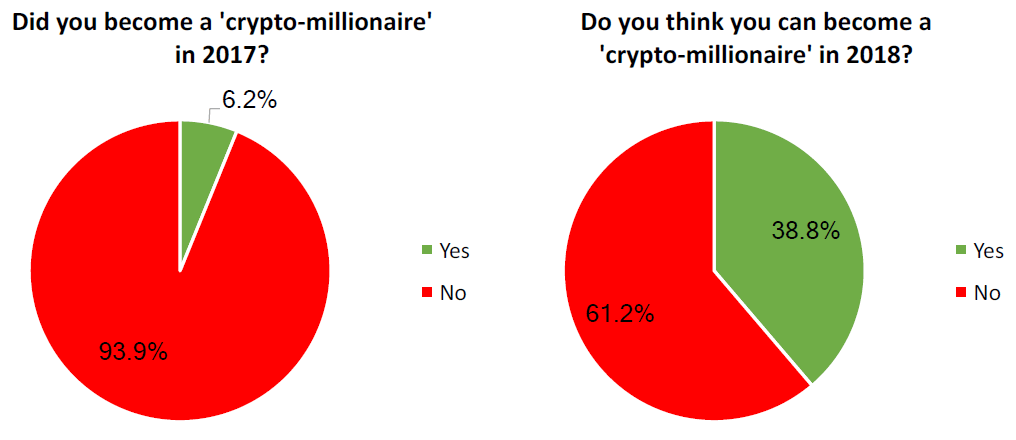

And a little optimism in the end. Among investors surveyed by CoinDesk, only 6.2% said that in 2017 they became cryptomillionaires. But 38.8% think that they will succeed in 2018.

Source: https://habr.com/ru/post/410035/