Accounting for programmers

Introduction

Engaged in accounting automation for 17 years. After university, he worked as a programmer for an accounting program. It turned out that there is a demand for programmers of this program. Changed one job, the second. Began to take orders on the side. It turned out (or it seemed) that it is more profitable to execute orders than to receive a salary. Became a private entrepreneur. It turned out (or again it seemed) that selling a program is more profitable than programming. Became a dealer. It turned out that the most profitable thing is to subscribe for updates and maintenance. It may be even more profitable to make a web service for online accounting ...

In the course of the work, we had to hire programmers and teach the basics of accounting. When I taught programmers to book, I liked to tell them all the basic theory in an hour. It's nice to tear the covers of complexity and mystery. It turns out that accounting courses are not needed by anyone. There is no such science. Is that a set of terms in which the accountants themselves are confused ...

Accounting is outdated. He was all coined to keep records on paper. And now, when he was gradually transferred to the computer, it turned out that many of the accounting rules simply lost their meaning. A computer program that was created for the implementation of accounting in the computer, killed the need for its implementation. Here are all the registers, magazine orders, cash books, general books, chess and other nonsense ... everything is already dying.

There is nothing difficult - this is the main secret. Accounting is easier than fifth-grade mathematics. Of course, when scaling complexity increases. But, relatively speaking, 80% of accountants use 20% of accounting theory. Which can be found in 15 minutes of reading.

Examples are given from the Ukrainian account.

In other countries, accounts may have other designations. By the way, this is one of the reasons for the confusion - the terms wander from one country to another, while in different countries they may have different meanings. I tried to use the most versatile and discard ambiguous.

So let's go ...

The term first, the Firm - the company, legal entity. PE, LLC, FLP or another type. Strictly speaking, FLP is an individual. But he is allowed to do business and have all the attributes of a legal entity. Therefore, it will also be called the firm.

Accounting Task

The task of accounting is to know everything about the company, which can be estimated and calculated. How much money is on hand, in the current account, in what amount of goods in a warehouse, in a store. How many goods are shipped, how many services are provided, how much is paid, how much furniture, equipment and buildings belongs to the company. How much should the firm suppliers and vice versa. How much tax will have to pay. Etc.

Strictly speaking, the accounting department does not have to know the quantity of goods, services, raw materials, equipment and furniture. She only needs to operate with amounts. But in the activities of the company the amount and amount are closely related. Therefore, it is usually considered that the accounting department should know the sum of all that is in the firm and the amount , if it can be calculated.

Accounting - accounting for everything in the company that can be counted in money and quantity.

Balance

The word Balance has two meanings:

- All that belongs to the company

- Accounting Report

They say that all that belongs to the company, its property, goods, loans and debts - all this lies on the balance sheet of the company.

The balance of the company is all that belongs to the company. You can ponder and say that the balance consists of the assets and liabilities of the company, but it will not become easier and the essence will not change.

Assets - that part of the balance, which the company can dispose of, money, property, goods. Those. what can sell and get money. Well, the debts to the company.

Liabilities - debts and loans of the company. Another authorized capital, but he, in fact, the debt of the company to the founder.

Another balance is such an accounting report. It is also called the main accounting report, because it shows everything that belongs to the company.

Balance - an accounting report, which shows the balance of the company. Logically, no one would argue.

Account

The word score is an overloaded word. Do not worry, this is normal. Where necessary, we will clarify the value. You must remember that there are three types of accounts:

- bank account (where your non-cash money is kept)

- invoice, as a document to be paid (a document where the amount to be paid and payment details are visible)

- an account.

For convenience, all possible types of money, property, goods, services, taxes and settlements are grouped and have a special classification - accounting accounts.

Account - the symbol of a group of similar in meaning monetary amounts or calculations.

It can be net money, securities, taxes, things, debts. Each such group has its own designation.

For example, a 301 account is the amount of money on hand. Account 311 is the amount of money in the bank. Account 281 stores the entire amount and quantity of all goods in the company's warehouse. The score 105 is the transport that belongs to the company and its value. Etc.

When they talk about the amount of a particular account, they usually say:

- “such amount lies or is stored on account 301”

- or "on account 281 is so much goods"

A chart of accounts is simply a list of all-all accounts that are in accounting.

It often happens that the amount of calculations for one boo. the account is complicated and requires additional division into groups. In this case, you can add subaccounts. For example, account 281 “Goods in stock” may contain additional sub-accounts:

- 2811 "Goods in stock in reserve"

- 2812 “Goods in stock overdue”

In this case, the accountant knows that you can only sell goods from account 281, the goods on account 2811 are waiting for the customer to pick them up, and the goods on account 2812 will wait for a return until the supplier takes them.

A sub account is a regular account that is part of another account. As an additional folder in the folder. Its number consists of the parent account number and an additional digit. Sub-accounts are established for the convenience and discretion of the accountant.

Wiring

In order to accurately calculate and know how much of what is stored on which account, the accountant must record incomes and expenses for each account.

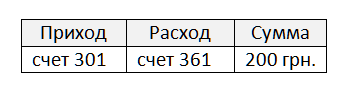

For example, the buyer paid 200 UAH. to the cashier. This can be written as follows:

As you remember, the 301 bill is the amount in the firm’s cash office. Account 361 is called “Settlements with customers”. This is already a real accounting entry. As you can see, nothing complicated.

Accounting posting is a record that shows two invoices and an amount that goes from one account to another. Each wiring must contain three values:

- account that increases

- account that decreases

- amount.

Strictly speaking, the amount is optional. But then the wiring will be like a bill in the zero hryvnia. You can pass it from hand to hand, but nothing will change.

Double entry - the main rule of accounting. Any movement on accounts should affect two accounts, income and expenditure. There is no transaction with one account. The term can be forgotten, but the basic rule must be remembered.

Debit and credit - words that mean the income and expense, and nothing else.

Debit - parish, abbreviated as "DB."

Credit - expense, abbreviated "CR". (stress on the first syllable)

Mnemonic rule to remember:

DeBet - Adds. Credit - Steal.

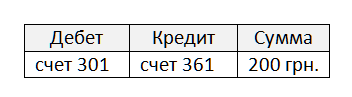

Now the wiring will look like this:

It is easy to notice that our wiring lacks information. For example, dates. We must understand when the event occurred. It is also advisable to indicate the buyer, i.e. who paid the amount:

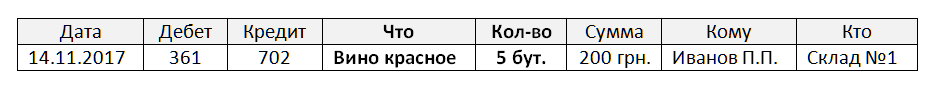

And how will the wiring of the transfer of goods to the buyer? No wonder he paid.

Account 702 - account of income from the sale of goods. It is interesting that nothing comes to this account, on the contrary, all the time something is leaving. This means that the balance on this account must always be negative. But accountants are simple people and do not like negative numbers. Therefore, they write a negative balance without a minus and call a credit balance. By the way, instead of the word balance, accountants say balance.

The balance is just the balance of the account. And nothing more.

The debit balance is a positive balance.

The credit balance is a negative balance. It is recorded without a minus sign.

At the checkout can not be minus 200 UAH. There are no bills with a minus. Therefore, the account 301 always has a debit balance. On the other hand, on account 702, where it is noted how many goods are sold, there will always be a credit balance. These accounts are called active and passive.

An active account is an account where only a debit balance can be.

Passive account - an account where there can only be a credit balance.

But what about the account 361 "Account of accounts with customers"? We can first ship the goods, and there will be a debit balance, and we can first get paid, and there will be a credit balance. Yes, there are such accounts too. They are called active-passive.

Active-passive account - an account that can be both credit and debit balance.

And if the company bought the goods in the boxes, but did not buy the boxes (container)? They need to unload and give the supplier. These boxes do not belong to the company (they are not on the balance sheet), but they need to be counted. They are taken into account on account 026 “Tara in storage”. This container is out of the balance sheet of the company, it is “beyond balance”.

Off-balance sheet - an account on which can be anything. The balances on this account are not on the balance sheet of the company. This account does not appear in any reports of the company.

Let's return to our sale. We know the amount of the sale, but it would be good to indicate the product and its quantity. Then the wiring will expand a little more:

Now the accounting entry contains enough information:

Date, debit, credit, what, how much, amount, who, to whom.

This information is sometimes called posting analytics.

Analytics - basic wiring information.

Most often these are the fields used in the posting table. Not necessarily all of them will be filled, it depends on what event the transaction reflects in the account. However, more often there is a need to add more details, such as the name of the seller, the name of the store, a discount, the type of payment, and so on ... Any additional information to the wiring is called additional analytics.

Additional analytics - additional information in the wiring.

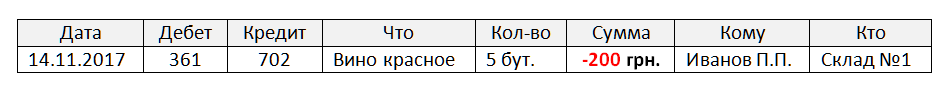

As we mentioned earlier, accountants do not like negative numbers, but there is one exception. If we do return the goods. Logically, we would have to write the wiring: debit 702, credit 361 for 200 UAH. But in the case of returns, the accountant again writes the sale transaction with only a minus and red color. No one really knows why, probably the accountants do not like returns. The return posting will look like this:

Posting with a negative red number is called reversal.

Reversal - posting with a negative amount, that's all. Marked in red. Used when returning goods.

By the way, you can buy / sell not only goods, but raw materials, spare parts, materials, cars, furniture and much more. All this is called commodity-material values.

Goods and materials - all that you can count, buy or sell (inventory items.)

In addition to goods and materials, the company has property that it does not intend to sell, but simply uses. These are computers, chairs and tables for workers. Furniture, computer equipment, transport. The property of the company may be buildings, buildings, land, securities. All property that does not create a commodity-money turnover is called non-current assets.

Non-current assets - property that is used in the activities of the company. Appliances, furniture, transport, buildings, etc. Another name is fixed assets.

Fixed assets (OS) - see non-current assets.

It is clear that in the course of activity the fixed assets become obsolete and wear out. This is called wear. It is logical that wear reduces the cost of fixed assets. One of the objectives of accounting is to correctly calculate the wear. The depreciation calculation is called depreciation.

Depreciation - reducing the cost of the OS during their operation.

OS depreciation - depreciation calculation.

Documents

When selling goods and materials, the seller prints a special document indicating the seller, buyer, list of goods and materials, quantity and amount. This document, as it were, is superimposed on the top of the goods, which is why the Consignment Note on the goods is called or simply the Consignment Note.

Consignment note - a document confirming the transfer of goods and materials from the seller to the buyer.

For the buyer, the document is called a receipt invoice. The same document for the seller is called the expenditure invoice. Document one, and two names. Question point of view.

Consignment note - the invoice, which makes the seller.

Invoice - the invoice that the buyer receives.

By the way, you can trade not only goods, but also works and services. In this case, the seller is called the service provider and instead of the invoice is printed an act of delivery of work.

The act of delivery of works / services - a document confirming the fact of the provision of services (or performance of work). For the supplier, this document is called the Delivery Act, for the buyer, the Acceptance Act.

The primary document is the same as the primary documentation, it is also the “primary organization”. These are all documents that are the basis for creating the postings. Consignment notes, acts, payment documents, tax invoices and, in general, almost all the papers exchanged between firms.

A good accounting program requires you to enter only primary documents into it, and it forms all the transactions itself. Then all reports are filled in based on the postings, automatically. Currently, any posting appears on the basis of the primary document.

However, sometimes an accountant has to create postings that are not associated with any document. In this case, he uses a special universal document called an accounting certificate.

Accounting reference is a universal document for creating any transactions.

The appearance of an accounting statement is almost arbitrary, but usually it looks like a list of several entries.

For example, an accounting statement is used when making initial balances on all accounts. When an accountant starts working with a new accounting program, he needs to add all existing account balances to the program database. For this, a special account is used - the account of the opening balance.

Account opening balance - a special account for making balances on accounts in the new base.

Reports

A report is a word overloaded with meaning, so it often causes some confusion.

Reports come in two forms:

- reports for delivery,

- tabular reports.

In fact, in life there are also other reports on the work done, for example. But they have nothing to do with accounting.

Reports for delivery - look like documents, have a clearly defined by law appearance (for printing on paper), as well as a strictly established electronic form (XML file format). These reports are intended for delivery to the regulatory authorities: the tax office, the pension fund, statistics, and so on.

Reports tabular - these reports do not give up anywhere and are intended for the needs of the company and accounting. Sometimes these reports have a statutory print form and must be kept in the accounting department for tax purposes in the event of an audit. But most often they look arbitrary and are not stored for a long time.

The easiest thing to remember is the difference between the two reports as follows:

Reports for delivery - you can edit.

Tabular reports - cannot be edited.

Reports for delivery - similar to the documents, their appearance and content is established by law. Usually the accounting program fills them in automatically. Often makes it possible to edit manually. Even if the program does not have enough data to automatically fill out the report, you still need to fill it in and submit it to the tax report. Sometimes they are called “Reports for tax”, or “Reports in statistics”, etc.

Each such report has the exact name established by law, for example, “Tax return on value added tax”. Often these names are too long, so they are usually called in abbreviated form, for example, “VAT declaration”.

Table reports look like tables, their appearance is almost arbitrary, but they cannot be edited. More precisely, it makes no sense, since their goal is to show the data that is.

The balance sheet (SAL) is the most popular tabular report. The statement is simply another word for the report title. The balance is the balance, so one could call it a turnover report. But this is not cool. Therefore, they say the balance sheet. This is a tabular report that shows on the selected account balances at the beginning, turnover for the period and balances at the end.

WWS may not show balances, only turnovers. Then it is called the turnover list. The accounting program allows you to build various types of OSV.

Example SALT:

Instead of goods and materials can be any other information: accounts, warehouses, sellers, buyers, any other analytics. You can not build the remains, but only momentum. And on the contrary, not to watch turns, but only to look at the remains. You can add quantity and price to the report. You can use two, three several analyst. You can build on dates.

It all depends on what kind of data you want to see. Of course, it is most convenient to build such reports using an accounting program.

Any accounting report is constructed for any time period. For a day, a week, a month, a quarter, a year, or just an arbitrary period, for example, from April 25 to May 9, 2020. The exception, perhaps, is the reports that show the balances on the specified date, but even such reports are constructed for the period, only show data on its beginning or end.

The time period is as simple a concept as it is convenient and often used. Almost all the time the accountant works in any period, it is called the working period.

The working period is the period in which the work is being conducted. Documents are created and reports are built. It can be arbitrary, from one day to several years.

Reports for delivery have exactly the specified period for which they must show data. This period is called the reporting period.

Reporting period - the period for which you need to submit a report to the regulatory authorities. This is usually a month, a quarter (one quarter, two or three) and a year. There are reports that need to be submitted once a year, there are - every month.

The subject of accounting activity - or briefly the Subject. This is a natural or legal person that may appear in the transaction as a sender, supplier, recipient, seller.

Correspondent - see Subject. By definition, this is one of the parties that exchange documents, so sometimes accountants use this term instead of the Subject. After all, all firms exchange documents.

Cash book - a report, which shows the turnover on the account 301 (cash) by day. The type of report is established by law. It is necessary to print and store it.

VAT (the most boring chapter, you can skip if not interesting)

Value Added Tax (VAT) is an interesting tax. Usually is 20%.

There are several concepts associated with it that you probably heard about: tax invoice, VAT payer, VAT defaulter, first-second event.

The easiest way to figure out the example.

The company bought goods for 1000 UAH. + 200 UAH. VAT. Total paid 1200 UAH.

The company sold goods with a profit of 1500 UAH. + 300 UAH VAT. Total received 1800 UAH.

The company paid 200 UAH. VAT, and received 300 VAT. So another 100 UAH. She must give to the state.

The company added to the cost of goods 500 UAH. I transferred 20% (100 UAH) of value-added tax to this “value added”, i.e. VAT.

That's all, nothing complicated.

The question is, who is the tax payer? Firm? Nothing like this. The company received 300 UAH. and gave the same 300 UAH. All VAT paid by the Buyer. The company only worked as an intermediary between the Buyer and the state.

VAT payer - an intermediary between the real VAT payer and the state. A firm that is obliged to take tax from the end user and pay it to the state. You can even say it is a representative of the tax inspection for the buyer.

Since the VAT payer is almost a representative of the tax inspectorate, he must give the Buyer an official document confirming that the Buyer has paid the VAT. Such a document is called a tax invoice.

Tax invoice - a document that confirms the payment of VAT. Often it is called briefly "tax."

As in the case of a regular Invoice, the name of the Tax Invoice depends on the point of view. For the Seller, it is called the Expense Tax Invoice, for the Buyer - the Income Tax Invoice. But that would be too easy, accountants say otherwise.

If the company received VAT (sold something), it is not her money, she is obliged to give it to the tax, i.e. she had a tax liability.

If a firm has paid VAT (bought something), this is a tax that it has actually already paid to the state, it has a tax credit.

Tax liability - see Expenditure tax invoice. VAT related obligations.

Tax credit - see. Income tax invoice. VAT actually paid.

And if the company received payment with VAT, but has not yet shipped the goods? All the same. The company has already received VAT, which means it must transfer it to the treasury. She has a tax liability and must issue an Expenditure Tax Invoice.

It doesn't matter what came first, the chicken or the egg. Whatever the first event - pay VAT. Suppose a company sells an elephant for 10 thousand hryvnia (plus two thousand VAT) and received an advance payment of six thousand. An accountant prints a tax invoice for a half-elephant. The first event, nothing can be done. The second tax invoice the accountant will print when the elephant is shipped. Shipment will be the second event.

Note, if they paid for the elephant entirely, immediately 12 thousand, then immediately it is necessary to make a tax invoice for 12 thousand, and during shipment simply stick to the elephant expenditure invoice, without tax.

The first event is the first payment or shipment. Means that the Firm should already print out the tax invoice and already owes VAT to the state.

The second event - payment or shipment, which occurred the second.

Note that the concept of “first and second events” is used in approximately the same sense when calculating the Income Tax. But everything is more complicated there, let's not talk about it.

VAT

Value Added Tax (VAT) is an interesting tax. Usually is 20%.

There are several concepts associated with it that you probably heard about: tax invoice, VAT payer, VAT defaulter, first-second event.

The easiest way to figure out the example.

The company bought goods for 1000 UAH. + 200 UAH. VAT. Total paid 1200 UAH.

The company sold goods with a profit of 1500 UAH. + 300 UAH VAT. Total received 1800 UAH.

The company paid 200 UAH. VAT, and received 300 VAT. So another 100 UAH. She must give to the state.

The company added to the cost of goods 500 UAH. I transferred 20% (100 UAH) of value-added tax to this “value added”, i.e. VAT.

That's all, nothing complicated.

The question is, who is the tax payer? Firm? Nothing like this. The company received 300 UAH. and gave the same 300 UAH. All VAT paid by the Buyer. The company only worked as an intermediary between the Buyer and the state.

VAT payer - an intermediary between the real VAT payer and the state. A firm that is obliged to take tax from the end user and pay it to the state. You can even say it is a representative of the tax inspection for the buyer.

Since the VAT payer is almost a representative of the tax inspectorate, he must give the Buyer an official document confirming that the Buyer has paid the VAT. Such a document is called a tax invoice.

Tax invoice - a document that confirms the payment of VAT. Often it is called briefly "tax."

As in the case of a regular Invoice, the name of the Tax Invoice depends on the point of view. For the Seller, it is called the Expense Tax Invoice, for the Buyer - the Income Tax Invoice. But that would be too easy, accountants say otherwise.

If the company received VAT (sold something), it is not her money, she is obliged to give it to the tax, i.e. she had a tax liability.

If a firm has paid VAT (bought something), this is a tax that it has actually already paid to the state, it has a tax credit.

Tax liability - see Expenditure tax invoice. VAT related obligations.

Tax credit - see. Income tax invoice. VAT actually paid.

And if the company received payment with VAT, but has not yet shipped the goods? All the same. The company has already received VAT, which means it must transfer it to the treasury. She has a tax liability and must issue an Expenditure Tax Invoice.

It doesn't matter what came first, the chicken or the egg. Whatever the first event - pay VAT. Suppose a company sells an elephant for 10 thousand hryvnia (plus two thousand VAT) and received an advance payment of six thousand. An accountant prints a tax invoice for a half-elephant. The first event, nothing can be done. The second tax invoice the accountant will print when the elephant is shipped. Shipment will be the second event.

Note, if they paid for the elephant entirely, immediately 12 thousand, then immediately it is necessary to make a tax invoice for 12 thousand, and during shipment simply stick to the elephant expenditure invoice, without tax.

The first event is the first payment or shipment. Means that the Firm should already print out the tax invoice and already owes VAT to the state.

The second event - payment or shipment, which occurred the second.

Note that the concept of “first and second events” is used in approximately the same sense when calculating the Income Tax. But everything is more complicated there, let's not talk about it.

Incomprehensible terms

Before there were no computers, but there was an accounting department. Therefore, to help themselves in their work, accountants have come up with different types of reports that are not needed by anyone, but they help to keep bookkeeping on paper. Then computers appeared and automated accounting. Including automated construction of accounting reports.

The result was an interesting situation. The accounting program is made in order to build all the accounting reports. At the same time, the accounting program itself has eliminated the need for many accounting reports. Since there is no need to re-examine the work of an accountant and look for errors.

Often, accountants, especially those who find accounting without computers, are still aggressively looking for and building old reports in order to see the information in their usual form.

A business transaction is an event in a firm’s business that requires the recording of one or more transactions. The term is logical, but there is no use for it. Now posting groups appear along with the primary document.There are almost no separate business transactions.

Posting journal - does not happen. Contains all wiring. Mentally imagine a thick-thick book, where all the transactions of the enterprise are recorded in a row. Even the most persistent accountants could not work in it. Therefore, it led in parts. A separate part was called a warrant. Interestingly, in the computer program the posting log often exists. This is just a large table in the database. One entry in the table - one posting. For modern computers it is a pleasure to work with it.

Order warrant- out of date. A group of transactions that are collected on some basis. You can find some old book on accounting and see a list of order journals with the rules for filling them out. Sometimes accountants like to call ordinary reports “Journal-order by customers”, for example.

Registers of accounting - see Journal-order.. Sometimes it is mistakenly considered an analogue of an account.

The main book is outdated. Report showing the turnovers for each account on a separate sheet monthly.

Chess statement("Chess") - a report where the accounts are vertically and horizontally, and in the cells there are turns between the corresponding accounts. This report was also invented when there were no computers. He helped find errors in accounting. Sometimes accountants like to build this report, we will not blame them, it is beautifully called and looks beautiful.

Tax accounting is an attempt to somehow separate the calculation of taxes into a separate type of activity. What is the point in the work of an accountant, if he does not calculate taxes and does not fill out reports to the tax office? Tax accounting is just a part of accounting. And mandatory.

Management Accounting- an attempt to single out the construction of some reports into a separate type of activity. What is the point in the work of an accountant, if he does not build a balance? And this is the most natural management report. If we read any definition of Accounting, we learn that one of its main tasks is to provide information for managing a company.

Financial accounting is another attempt to single out the filling of some reports into a separate type of activity. It sounds a little ridiculous if you remember that finance is money. The accountant generally operates with monetary amounts, otherwise it does not happen.

It makes sense to divide tax, management and financial accounting in a large enterprise, since for large enterprises it is generally peculiar to separation by type of activity. In fact, these are just separate tasks that accounting solves.

Subkonto - does not happen. (from the English. subcount subaccount) Same as analytics posting. Even those who are accustomed to using them are confused in definitions. It can mean any analytics transactions: invoices, accounting objects, suppliers, buyers, contracts ...

Invoice - see invoice for payment.

Regular reports - see Reports for delivery. Where does the term come from is unknown. Sometimes the origin is explained by the word Regulation. Although it does not become clearer.

Counterparties- in jurisprudence, the parties that have entered into a contract are so called Inoda accountants use this term to designate a Business Entity.

Nomenclature - see TMC. Sometimes it is so mistakenly called reference TMC.

Synthetic accounting is outdated. When there were no computers, to simplify work, all records could be kept only in monetary terms, without analytics and without quantity. Literally one accounts and amounts. Now this does not happen.

Analytical accounting - see Accounting. So called because in the wiring is not only the amount, but also analytics: the number, objects, subjects and everything else. The word is almost out of use. Now any accounting is analytical.

Synthetic account- by analogy with synthetic accounting, an account where only amounts are recorded. Just like the analytical account, it is outdated and not used.

White accounting - all activities that are involved in the calculation of taxes. All that can be shown if the inspection comes from the tax inspectorate.

Black bookkeeping is white plus everything that happens in a company. Understand differently, sometimes it is only that which can not be shown, sometimes all together with white.

Form one (F1) - conditional (secret) name of all documents in white accounting.

Form two (F2) is the conditional (secret) name of all black bookkeeping documents.

Accountants say “documents in form one” or “documents in form two”.

Conclusion

I’m not going to talk about Salary yet, because if you are going to charge a salary, you probably know what you are doing.

You have become acquainted with the basic accounting concepts. They are already enough to work with the accounting program. Many accountants like to use different incomprehensible words. Apparently, to emphasize the importance of their work. The work of an accountant is important, but many terms are unnecessary or outdated.

Even experienced accountants are often confused. Do not be scared and do not try to argue with an accountant, just specify what he means. Most likely, this is another name for simple and familiar terms.

Good luck!

Source: https://habr.com/ru/post/410275/