Save money and avoid fraud: where and how do people use face recognition in Russia

It’s easy to circle us around: it has been proven that when recognizing a person’s face we are mistaken about 10 times more often than a machine. Studies were conducted at the University of Massachusetts based on VisionLabs algorithms.

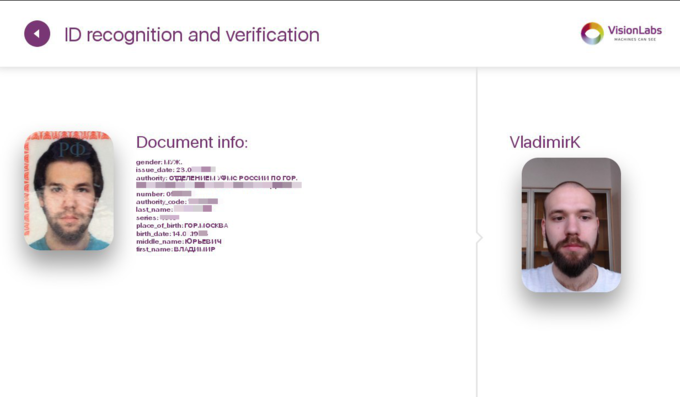

VisionLabs is a platform that allows you to recognize faces with high accuracy. The main drawback of modern facial recognition technologies is the deterioration of the quality of work in low light and changing the position of the head or angle.

Therefore, most of these technologies are not accurate enough to introduce them into the business. But the VisionLabs algorithm was recognized by the University of Massachusetts as one of the best among the existing ones.

More about their platform and its capabilities, the company representatives will tell at AI Conference . In the meantime, they presented three real case studies with solutions already implemented.

VisionLabs: what is special about the platform and how does it work?

The VisionLabs LUNA platform analyzes not a picture, but a set of features derived from it. First, the technology detects a face in a frame and runs an algorithm for tracking it in a video stream — the program determines which of 25 frames per second captured the face in the best quality and perspective. The portrait, cleared from the background and rotated to the desired position, is sent to the recognition service. From the standard JPEG format, it is converted into a descriptor - a set of immutable facial parameters, which is used to later compare the image with another image. This eliminates such factors as the level of illumination of the room, age-related changes of a person, hairstyle and makeup, the presence or absence of a beard and mustache.

Further, the program compares two descriptors and gives an answer whether a person who has entered the frame is entered into the database. The similarity is determined as a percentage: for example, the system may return the result of matching the descriptors by 65 or 99%.

Banking: the amount of averted fraud is estimated at hundreds of millions of rubles

Objective: to prevent possible fraud by employees in the "Mail Bank"

The most common threat to banks is the leakage of personal data and their falsification, which leads to financial losses due to internal fraud, as well as to serious reputational risks and, as a result, a decrease in the value of shares.

According to the experience of VisionLabs, up to 90% of fraud in banks is committed by employees - on their own or in collusion with external fraudsters. The sectors in which fraud is most pronounced are consumer lending, ATMs and all remote banking services. In “Mail Bank” this problem was solved by authorization when accessing personal data in an electronic database - using face recognition technology.

Implementation process and results

The LUNA Face Identification and Verification Platform processes hundreds of thousands of photographs daily.

It compares the biometric parameters of new bank customers with the parameters already existing in its database, and also compares them with the database of fraudsters.

The platform was implemented for 50,000 jobs in the bank and points of sale of partners. There are no special requirements for cameras used at agents workstations. The bank assures that the quality of the image of almost any camera is sufficient for effective recognition of the client.

The economic effect of the introduction of the system is estimated by the volume of averted fraud: taking into account the growth dynamics of the retail network and customer base, the bank estimates it at hundreds of millions of rubles. At the same time, the number of attempts to commit fraudulent transactions has decreased, since potential fraudsters already knew about the face recognition system.

In addition, facial recognition made it possible to personalize each operation of employees in the bank. As a result, it has become easier to work with clients and the level of information security has increased. The photo of the logged-in user is saved, and the employee of the bank or partner point of sale cannot access the customer information. The labor discipline of employees has increased: the situation with the transfer of their data to other employees is completely excluded. The bank also has a tool for objective and accurate accounting of staff time.

Objective: to create the possibility of remittances on the customer's photo in the bank "Opening

Traditionally, to transfer money a customer needs to specify the recipient’s card number or his phone number if it is serviced at the same bank.

Otkritie Bank was the first bank in the world to launch money transfers in December 2017 based on a customer's photo.

Implementation process and results

The service is implemented using a face recognition system, which allows you to identify a client with his biometric data with a high degree of accuracy.

In the first quarter of 2017, the bank has already introduced in three Moscow branches a system for authenticating customers, which simplifies their maintenance and shortens the waiting time in the queue. Already at the beginning of the 2nd quarter, the bank used the development of VisionLabs in the bank’s mobile application for a prototype face authentication solution on iOS. The solution was tested by a working group of the bank, and in May 2017 it was presented at the international exhibition Connect: ID.

Translation by photo can be made from the card of any Russian bank to the clients of Otkritie Bank, which were photographed in the branches or upon delivery of the card by courier. Next year, Otkritie plans to launch translations from photographs and to users who are not bank customers — users of the Discovery. Translations ”will be able to upload their own photos directly through the application.

Education: students have become more responsible for learning

Task: to transfer the exam process to the online format at the Moscow Institute of Psychoanalysis

The institute has developed an educational portal for students, teachers and administration, but full-fledged work with it was impossible, since a large number of students tried to use third parties for exams. This could not be controlled, because the system used a standard password access mechanism.

Implementation process and results

Currently, more than 5,000 students get access to the course materials every week using biometric identification. Representatives of the institute not only identify students, but also analyze their activity when working with materials. About 5% of students try to use third parties for exams, but the system prevents all cases of fraud.

The institute confirms that biometric identification contributes to improving the quality of teaching students who no longer rely on illegal methods of passing tests and exams, but are more responsible in their preparation. Also, students began to more consciously and responsibly approach to working with materials, because they understand that their activity is recorded.

The Institute conducted a survey before and after the introduction of biometric identification. The survey showed that initially students reacted to such an introduction with distrust, because they were worried about increasing control over their activities on the training portal - but after the introduction, the institute received feedback from students who believe that now they are more consciously approaching their education and working with materials.

It will be possible to talk with representatives of the company and find out from them everything in details on April 19 at the AI Conference .

Source: https://habr.com/ru/post/410425/