Earnings cryptobirds, trading through a broker and HyperLedger Fabric: what was said at the blockchain conference in St. Petersburg

Cryptocurrency trading accounts of brokers are insured for thousands of dollars; the average daily trading volume on crypto-countertops is $ 1.782 billion; digital asset arbitrage brings a steady income, unlike cryptocurrency trading on stock exchanges; and HyperLedger Fabric will acquire Java and Node JS support for writing smart contracts. This was told by the speakers of the Blockchain Conference St. Petersburg.

Special guests of the event were:

Yaroslav Kabakov - Deputy General Director of Investment Company FINAM JSC.

Nikolay Rovneiko is the chief analyst of the Azbit investment platform.

Krzysztof Kolazhinski is the founder of the Stable Foundation investment fund.

Igor Hapov is the head of the virtualization tools development department at the IBM Science and Technology Center.

We introduce you to the main provisions of their speeches.

Trade cryptocurrency: on the stock exchange or through a broker?

Yaroslav Kabakov, deputy general director of JSC Investment Company FINAM, presented a report on cryptocurrency trading through a broker.

Yaroslav began a report with data from research and consulting firm Frost & Sullivan. According to the information, investments in blockchain startups have significantly increased in the United States since 2013.

In addition, the United States is in first place among all countries of the world in the number of such investments. They account for 36.9% of investments. Followed by the United Kingdom (14.8%), China (4.5%) and Canada (4%).

Currently, cryptocurrency trading is possible in two versions: through exchanges (Poloniex, Kraken, Bitfinex, Bittrex, Bitstamp, etc.) and through brokers (like FINAM). At the same time, FINAM gives access to trading in a real cryptocurrency (specifically, Bitcoin), and not a derivative instrument for it.

Of the other advantages of trading through a broker, Yaroslav pointed out the existence of a trading platform that is familiar to traders, and not limited functions of online exchanges. Also, all broker accounts are insured, and the trade itself comes with a narrow spread and a leverage of 1: 3. But at the same time, the exchange takes a commission for trading in the amount of 0.5% of the transaction amount and imposes fees for the transfer of positions to another day. At the same time, withdrawal of funds in Fiat is not subject to a commission.

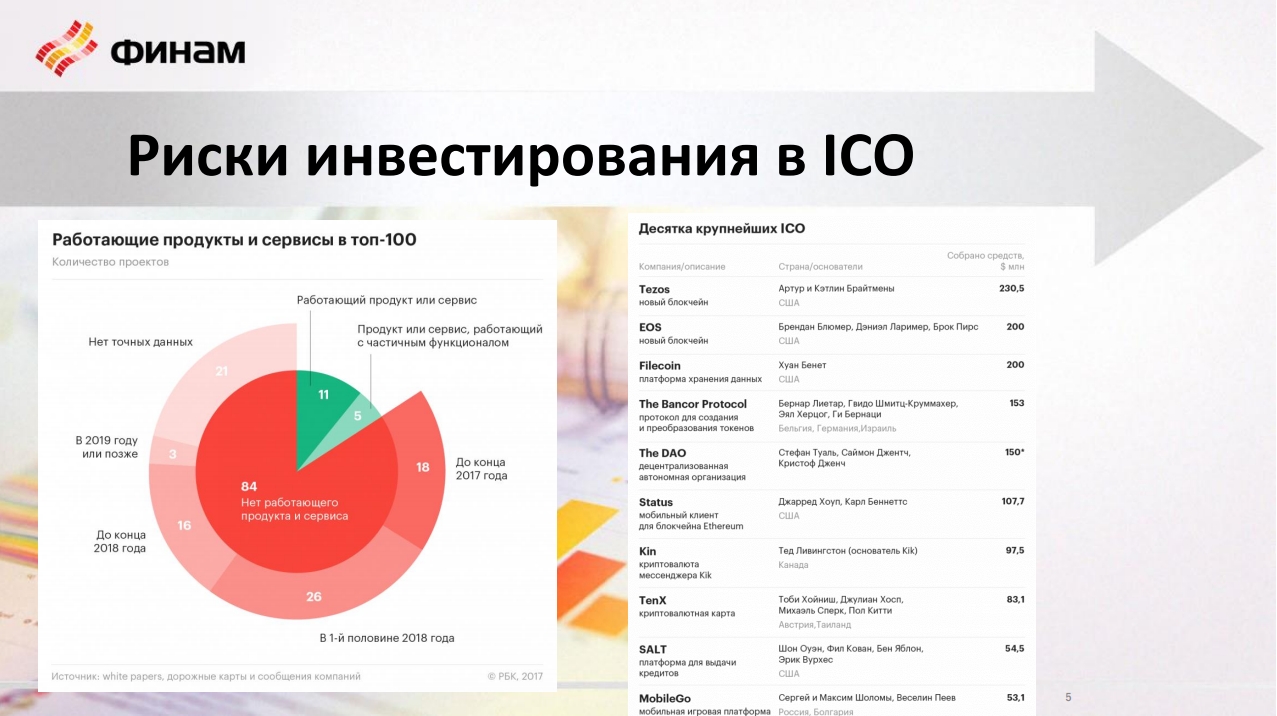

After that, the speaker turned to the analysis of investment in ICO-projects. Yaroslav provided data, from which it can be seen that those startups that are aimed at developing the blockchain infrastructure ($ 831.8 million) collected the most funds. In second place are projects in the field of finance ($ 638.9 million), followed by storage solutions ($ 237.2 million).

But at the same time, according to RBC, of the top 100 ICO companies, only 16 have a product or service that works at least partially. All others promise to launch the product for two years or more.

Yaroslav warned investors that, despite the high profitability of some assets, not all of them remain profitable: it is necessary to form an investment portfolio with caution, analyzing all the risks.

→ Download speaker presentation

How much do cryptobirds earn?

Immediately after Yaroslav, the chief analyst of the Azbit investment platform Nikolay Rovneiko appeared on the scene. He presented a related report on how and how much cryptocurrency exchanges earn.

According to Azbit, the cryptocurrency market in 2017 showed impressive growth: from $ 19 billion in January to $ 413 billion in December.

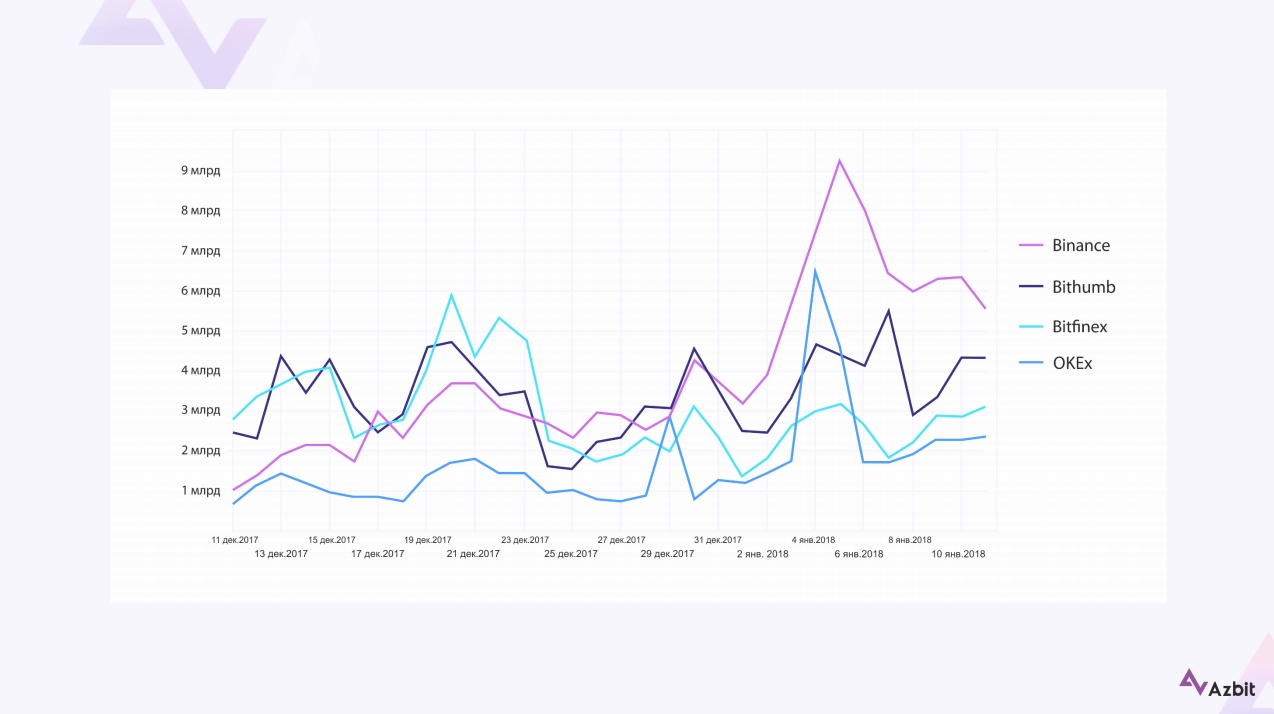

This led to the emergence of new cryptocurrency exchanges. Moreover, some newcomers were able to "move" more experienced market participants. Thus, the Binance Exchange, which is only five months old, took the first place in the daily circulation of cryptocurrencies. And the Kucoin exchange, which is even younger (3 months), entered the top 15 exchanges in terms of daily turnover.

According to the data provided by Nikolay in the presentation, the average daily turnover of the exchange, included in the top 3 cryptocurrency exchanges, is $ 1.782 billion. With a commission of 0.15% per transaction, this means that the income of such an exchange per day will be $ 2.673 million.

At the end of the report, Nikolay showed a daily turnover of funds on the Binance, Bithumb, Bitfinex and OKEx exchanges.

→ Download speaker presentation

Arbitrage of digital assets: stability vs risk

A special guest from Poland, the founder of the Stable Foundation investment fund, Krzysztof Kolazhinski, spoke about low-risk arbitrage trading strategies in the cryptocurrency market.

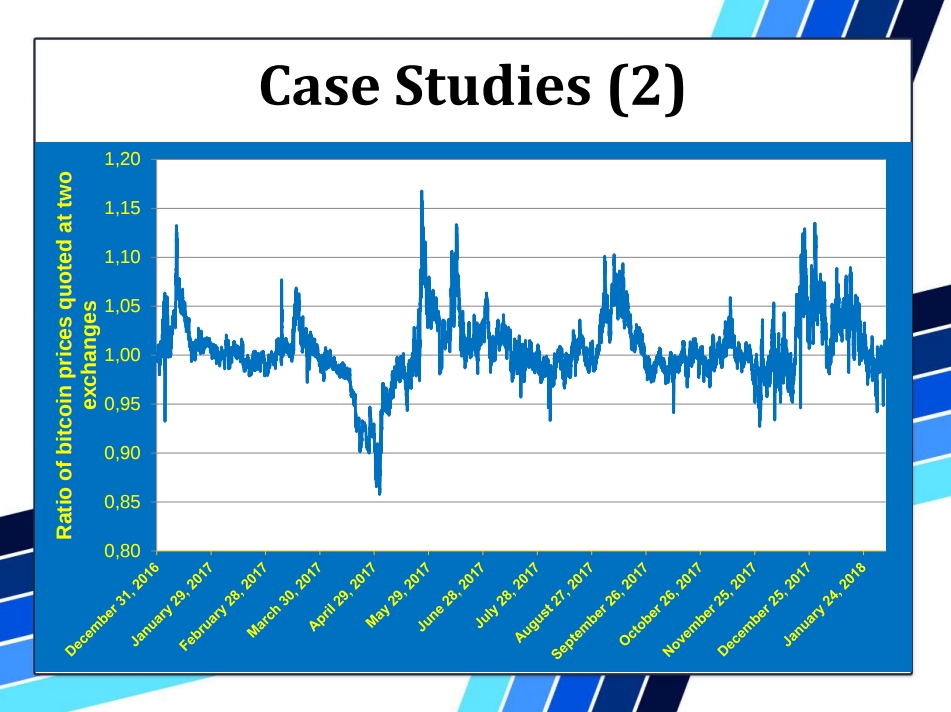

According to the speaker, the bitcoin volatility (as well as other cryptocurrencies) is one of the main reasons why ordinary users do not buy it. According to the data provided, Bitcoin volatility (more precisely, the decline in the rate after overcoming the peak) amounts to 70%.

The acquisition of cryptocurrency can be five or even ten times more risky than the purchase of traditional financial assets. Therefore, in order to reduce risks, Křishtof proposes to abandon the “buy and wait” strategy. He also does not advise to follow the HYIP and acquire tokens that most investors recognize as “interesting”. Instead, it is better to engage in the arbitration of tokens, buying tokens on stock exchanges cheaper and selling on another exchange, where the price of the token is higher.

The speaker said that cryptocurrency rates on stock exchanges can differ significantly - many factors affect this (starting from supply and demand, ending with the exchange commission for placing an asset). In confirmation of his words, Krzyshtof showed a graph of the difference in Bitcoin exchange rates on two different exchanges (Japanese and Korean).

According to him, trading on the difference in the rates of the two aforementioned exchanges gives a steady income. The $ 1 investment in January accounts for $ 2.5 profit in December.

→ Download speaker presentation

How do solutions work on HyperLedger Fabric?

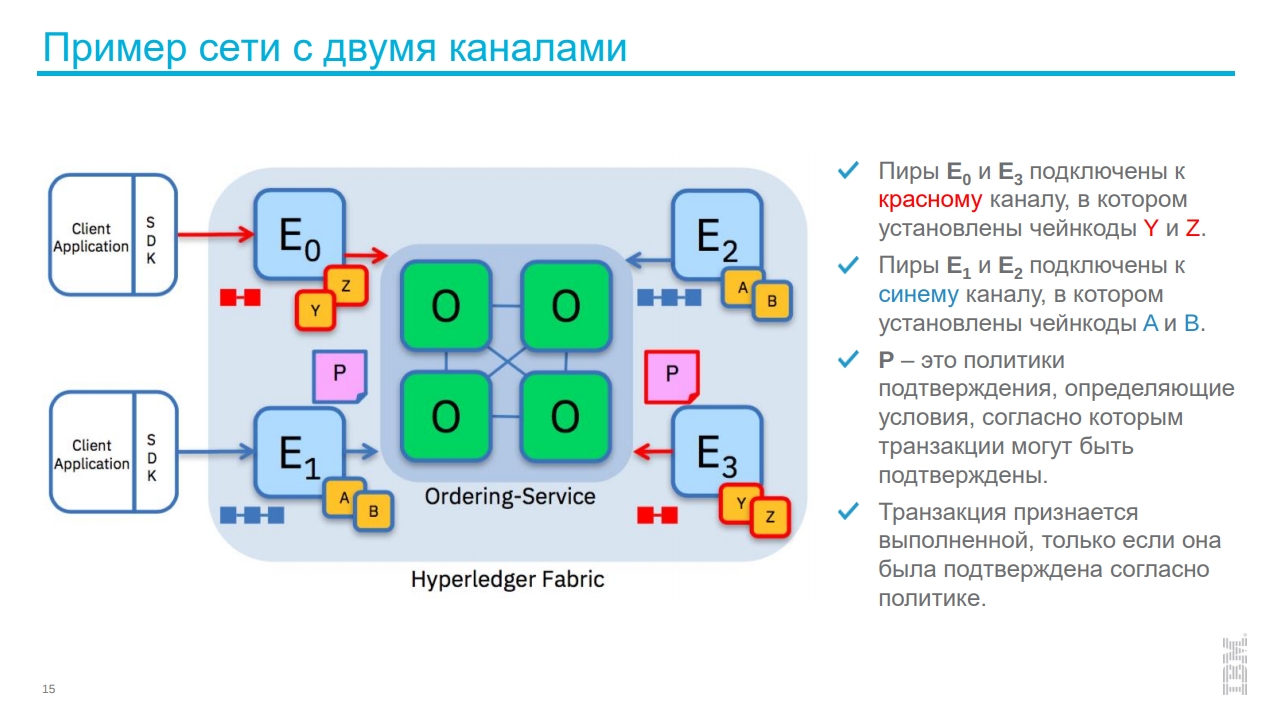

Igor Hapov, head of virtualization tools development at IBM Science and Technology Center, presented a report on the blockchain platform HyperLedger Fabric.

Of the advantages of HyperLedger Fabric, Igor highlighted the modular architecture and the sequential transfer of transactions to peers in the network. You can connect your account management module, cryptographic module, status database and consensus to Fabric.

HyperLedger Fabric's simplified architecture looks like this:

It has several nodes:

- Committing Peer, which supports the local version of the registry, records transactions and updates the data in the registry. In such a node, you can optionally install smart contracts.

- Endorsing Peer, which is involved in making a transaction execution decision. In this site setting smart contracts is required.

- Ordering Nodes, which form blocks of transactions to add them to the registry. They provide communication channels between the rest of the peers in the network.

Pavel gave an example of a network with two channels ...

... and described how transactions are performed on a network built on HyperLedger Fabric.

Read more - in the speaker’s presentation

Some more photos from the event.

The nearest blockchain event in Russia will take place on April 17-18 - Blockchain Conference Moscow . And in the spring, blockchain conferences will be held in Istanbul, Bangkok, Tallinn, Tel Aviv, Kiev, Berlin, Prague, Helsinki and Sydney. Read more about them on the Smile Expo website .

Source: https://habr.com/ru/post/410519/