How Singapore works with innovation: from government regulation to nightclubs

Hi, Habr! My name is Sergey Lukashkin, I am the director of project management in the management of digital transformation of DIT VTB. For many years I have been involved in fintech and innovations in the financial sphere. Of course, I spend a lot of time studying the best Russian and foreign Fintech practices. There are several iconic places in the world where people go to look at the innovation infrastructure and culture. One of these recognized places is Singapore.

I was able to visit and get acquainted with the innovative infrastructure of this amazing country as part of a special tour for VTB, organized by colleagues from Generation S, with whom we are doing a corporate accelerator for startups. In this post, I want to share my impressions of the trip, evaluate Singapore’s FINTECH infrastructure from different angles, tell you how they work with innovations in this country, and generally share the most interesting things about the places I visited.

In 1819, Singapore was a small settlement. It was then that Briton Thomas Stamfold Raffles founded a port there to represent the interests of the British Empire in this region. Therefore, the central square of Singapore is called Raffles Place (Raffles Place). And Singapore became an independent state in 1965.

This is a small country with an area of 722.5 square meters. km with a total population of just over 5 million people. The main population - the Chinese, Malays, Indians. The territory of Singapore is gradually increasing due to the program of the reclamation of territories. The country is highly dependent on external supplies of food and water.

The flight from Moscow to Singapore takes about 11 hours.

Acquaintance with Singapore's innovations began with a visit to MAS (Monetary Authority of Singapore) - this is a financial regulator, like our Central Bank of the Russian Federation.

MAS building. Source: businesstimes.com.sg

Getting passes to the MAS building is automated. Come to the terminal, scan your passport, enter data and get a temporary pass.

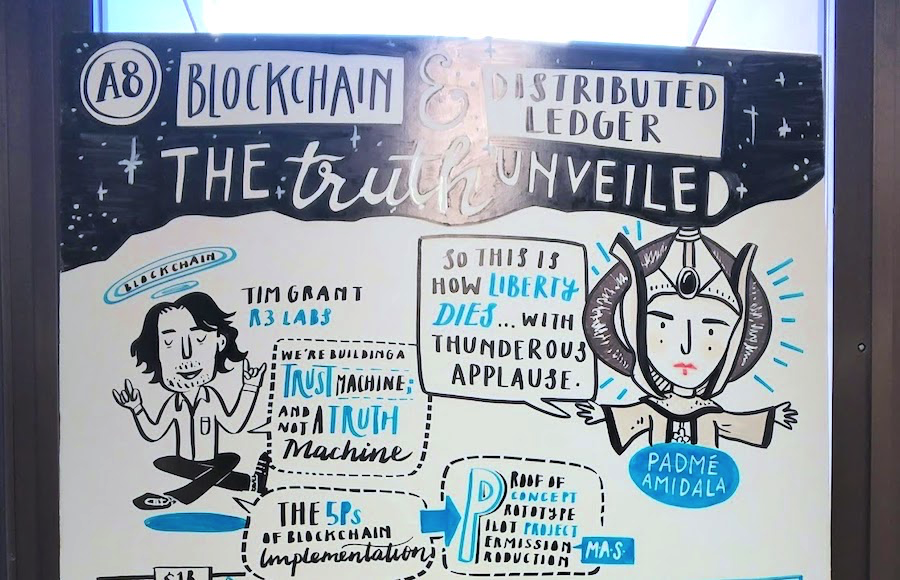

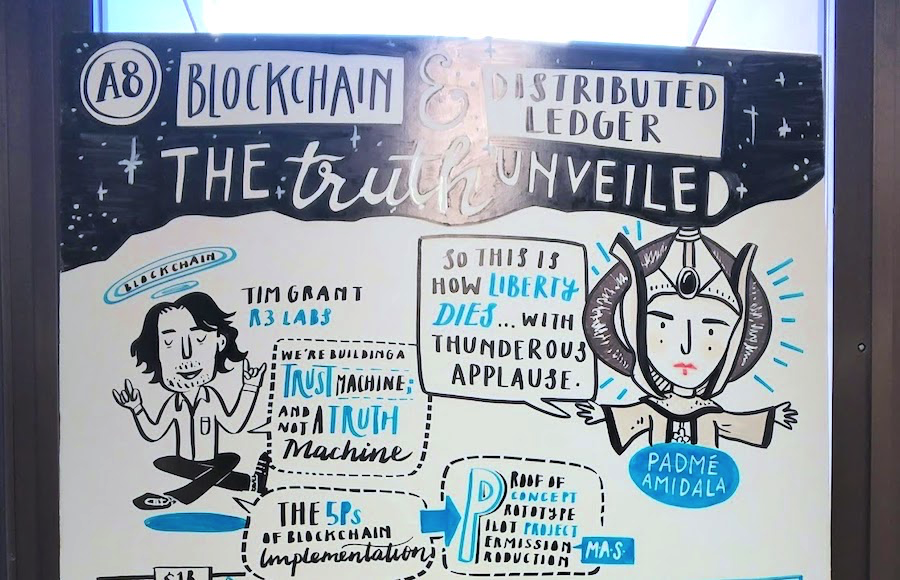

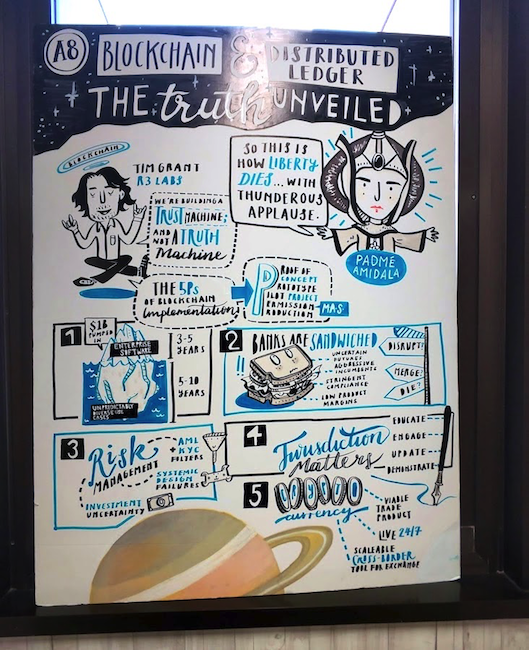

We went up to the floor where the MAS coworking is located - a modern room with a working space and a conference area. There are posters on the walls with the scribing of development trends of fintech and various project ideas.

We were met by Phung Kui Fei - deputy director of the innovative technology laboratory. The purpose of our visit was to find out how fintech in Singapore is regulated, what are the strategic directions of development and the main players here.

There are few local banks in Singapore:

In addition, there are a number of the world's largest banks, such as Citi, Bank of China, HSBC, JPMorgan Chase, Standard Chartered Bank and others. All this can be clearly seen at ATMs.

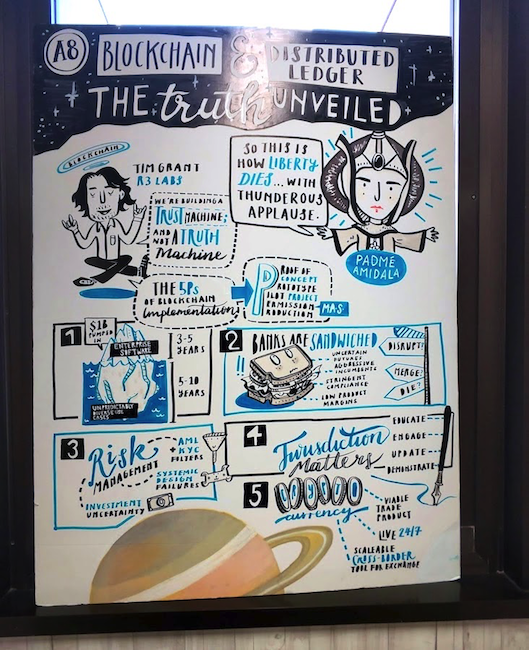

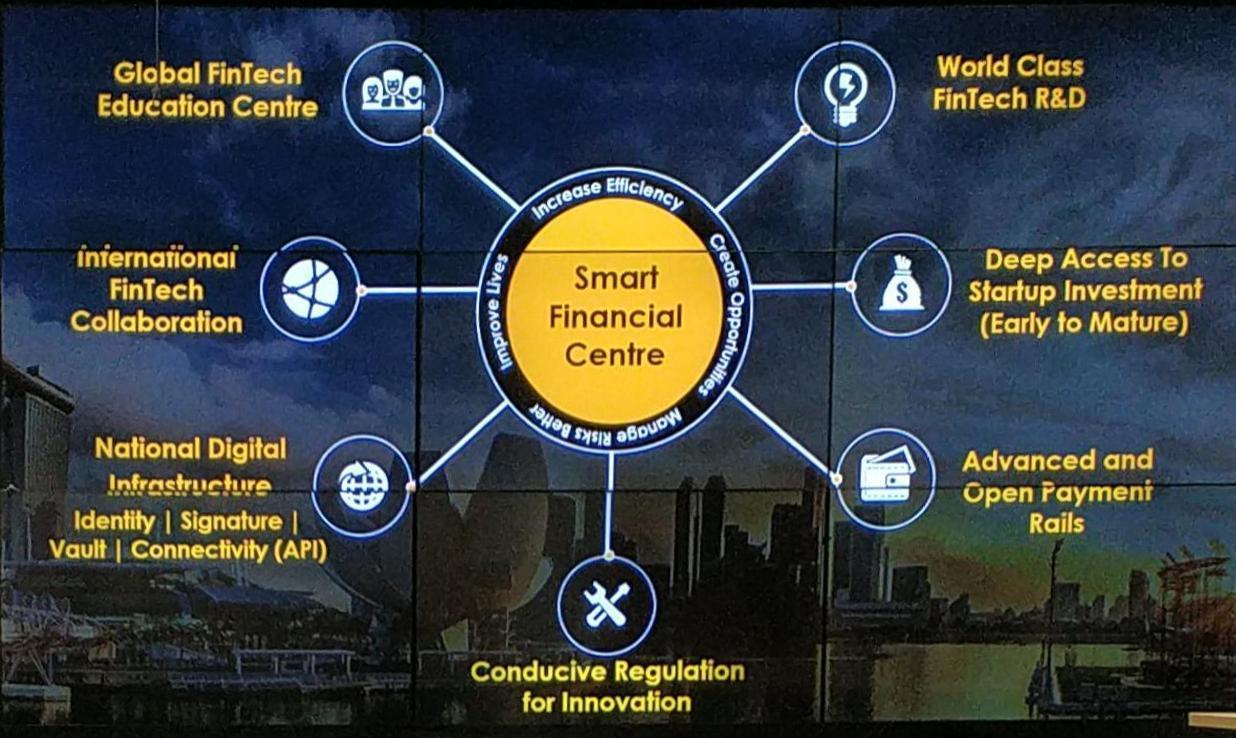

The main directions of development of Singapore Fintech:

Of particular interest to the regulator are projects related to artificial intelligence (AI), cybersecurity and distributed registries (DLT).

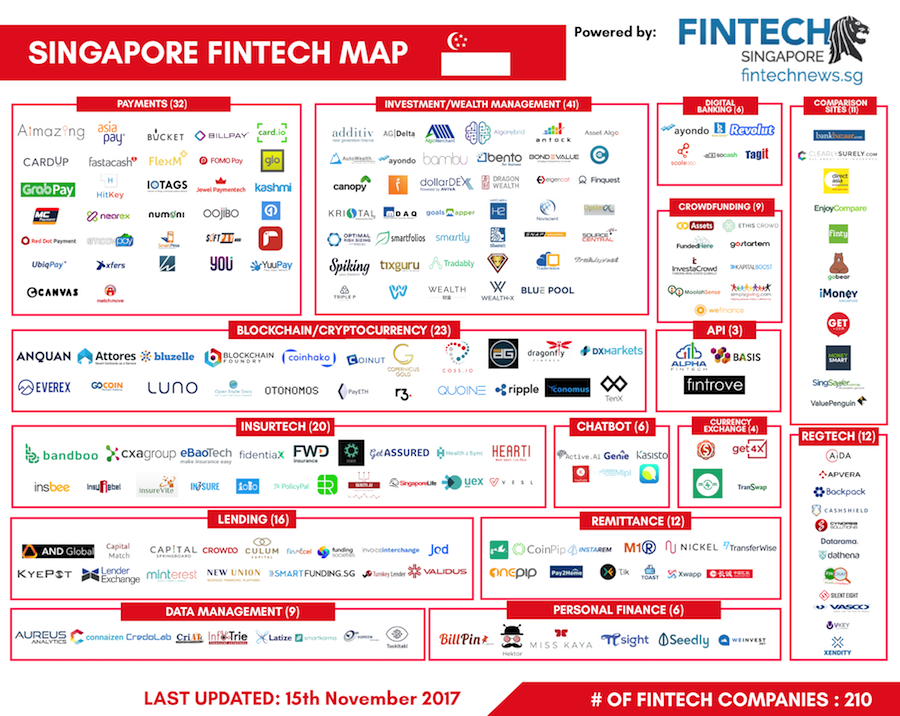

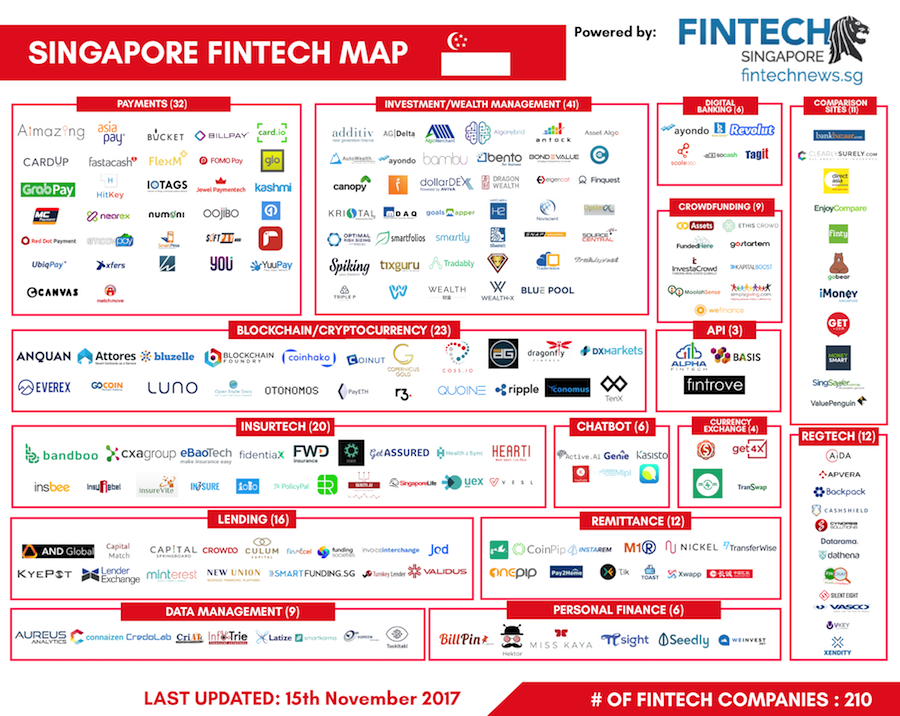

A list of Singapore fintech companies can be found here . Map by industry - here . The growth of investment in Phintech in Singapore is impressive. Just look at the slides below:

A source

A source

MAS is interested in the development and promotion of the Open API. They even conduct training events for banks to develop the Open API. A list of API and description of methods can be found on the MAS website. Another development priority is cloud technology. The regulator even once made an official statement approving work in cloud services.

MAS has a “sandbox” , but only those whose project is interested in the regulator and who may later need a license are allowed into it. If you do not need a license, then there is no sense for a startup, the Singaporean regulator is convinced.

MAS is also engaged in creating conditions for attracting investments in start-ups. For example, an annual FINTECH festival is held under its auspices. About the festival in 2018 you can read here .

The next item on our list after MAS was the Techstars accelerator, which works in partnership with WeWork coworkings, where startups are placed. TechStars says that large corporations, as a rule, do not understand how to work with startups. Because it is based on a different type of culture. They probably can be trusted - in TechStars, it turns out, they earn more not so much on the accelerator and related activities, but on investments in start-ups. The success of their investments is based on a deep understanding of the culture of innovative entrepreneurship and the availability of networks: a network of teams, a network of experts, a network of investors, etc.

Techstars talked about different models of work with start-ups and innovations:

TechStars thinks: the problem of large companies is that they immediately open venture funds, investment funds, accelerators - in general, something big and understandable for them. But this is not the beginning. To understand a startup, you need simpler forms of interaction - you can generally just call startups into your coworking for a joint work session. So you can get to know people, to understand whether it is possible to do a joint business. Then go to the pre-accelerator, then start the accelerator and, finally, open the foundation. And if you immediately start with the fund, it is likely that the company will invest in inappropriate startups, in unpromising processes.

Innovation is encouraged everywhere. The local DBS bank has a separate division for working with innovations. Their coworking is far from the main office, they live quite autonomously.

DBS is an ambitious bank. When his head decided that they should become number one in Fintech, he set a motivation for innovation in a separate line in the budget - 2%. Innovation awards can be received by any DBS employee.

One day, the head of the DBT fintech lab came to the owner of the local club Zouk. In this, as in any other popular club, there is a problem of queues, when visitors crowd in the queue for cocktails, stand, wait, then crowd again to settle accounts.

DBS offered Zouk a solution to this problem — a chat bot, through which a visitor, if he is a DBS client, can order and pay for a drink. And then just come up and pick it up. DBS did everything for free, with the only condition - it provides all the acquiring. Now this solution works great. And DBS potentially received the entire audience of the club and simultaneously solved its problem.

Such openness to everything new is characteristic of the Singapore business. There you can register a company in two or three days and start working normally. Easy to reach decision makers. Startups are given different concessions, including tax. But pilots, of course, do not open at the moment, you still need about six months to begin work, for example, with a bank. Banks, for their part, are actively providing startups with OpenAPI, letting them into their sandboxes.

We also visited another bank, Standard Chartered Bank. They have a division of SC Ventures, which integrates a laboratory, a program of internal entrepreneurship and the creation of open platforms. On the internal portal of ideas you can describe your idea and get virtual funding from colleagues, which will be converted into real money if the project falls into the top of the best. Also Standard Chartered Bank has its own startup sandbox on Amazon services.

Standard Chartered Bank, like many Western and Asian banks, made a pilot with a distributed Ripple transfer system. One of the features of this system is the presence of a token, or a cryptoactive asset, which allows for interbank transfers. By the way, XRP - Ripple tokens, this is the only private cryptocurrency, which also trades on cryptobirds. At the time of writing the post, XR is the second most capitalized among cryptocurrencies.

However, the problem with the full-scale implementation of such systems is that the accounting department and the treasury do not know how to take such a token into balance. He does not have an appropriate legal status. When (and if) such a status appears, systems like Ripple will significantly change the global financial ecosystem. In the meantime, we are talking only about pilots, where Ripple and similar systems are used only for exchanging financial information messages - that is, only the part that is currently working through SWIFT.

We were in the innovation center Vodafone. They are actively promoting the Internet of things, through which data is collected. Interestingly, they use not only 5G-based technologies, but also Lora WAN standards.

We were told about the company's projects and showed various devices. For example, a tool for predicting the maintenance of trains - he predicts when it is time to repair these or other units, nodes. There is a pilot, where Vodafone hangs different sensors on cows to monitor their condition after giving birth, for milk. There are smart trash cans in which trash is pressed. When the trash can is clogged, he sends a signal for a garbage truck to arrive. This allows you to save on logistics. There are all sorts of beacons and similar security devices that Vodafone makes with Black Knight. Vodafone does not lock on its towers and communications stories, they are looking for technological solutions in many areas that Singapore lacks. For example, there are quite a few outdoor cameras in this country, but they are not able to extract and process data from records here.

At the National University of Singapore (NUS), we were shown how they work with unmanned vehicles, buses and boats. At the same time, design thinking is being actively used. NUS is convinced that the creation of robots and innovations and anything else begins with empathy - with an understanding of what is around. It is with the help of empathy that you can correctly design cars, including autonomous ones. NUS make a pilot and try to understand how these autonomous cars will move around the city, drive around on the road, who will use such cars. Humanitarian approach.

Also, the university is working on "soft" robots that are designed to manipulate fragile objects.

A professor at the institute said that when start-ups come to the institute, they are told: write 50 reasons why you cannot make your startup. And then go and burn the list. After that, of course, half of startups are not returned to the institute. But if you write and burn 50 reasons every day for three weeks and don’t quit, then the chances of a startup’s success are seriously increasing. The first 30 reasons are usually simple and clear, another 20 are specific. Of course, the reasons can be repeated day after day. A good way to understand what you are ready for, and to show discipline and perseverance. Although he does not guarantee against failure.

Source: fintechnews.ng

In addition, we visited TAIGER . The key in the title is the letters AI. This project deals with knowledge cognitive work automation - cognitive knowledge-based automation. It includes three products: iConverce - document validation, iSearch - intelligent adaptive search and iMuch - ontology construction.

Taiger launched a commercial project for document processing. When a whole package of documents comes to you, there is often a need to make sure that the content of the same fields in different places coincides - for example, the name of a legal person. Software from TAIGER highlights such fields and says whether the content matches or not, recognizing text from pictures if necessary. As a result, software based on the existing set of documents already offers a list of things that are worth checking out. Given the low resolution of images in banking scanners, this product looks useful.

The founder of TAIGER is Sinuhe Arroyo, a Spanish mathematician. For nine years he was engaged in AI, more precisely, semantics and ontologies, then he made a project in Spain. Two years ago, he moved the project and part of the development to Singapore to develop business further in Asia. His project is accredited by MAS, he is now actively implemented in banks.

While this language is not supported by this platform. But in Russia there are similar projects - for example, datafabric, which passed to the VTB accelerator.

Finally, we looked at Microsoft. There we were met by a Russian employee, who said that about five thousand Russians were officially registered in Singapore. That the development of AI is very important for administrative purposes. That in Asia you have to be polite, patient and very easy to formulate thoughts. If you keep quiet or hurry, they will think that you are showing off.

Of the FINTECH services in Singapore, e-wallets are very popular. At one time, there were many precedents related to infringement of information security, and now the issue of cybersecurity is very relevant for them. In general, Singapore has a large shortage of data scientists and other AI specialists, but at the same time, AI is considered very promising. TAIGER is one of the few projects in this area. The development of such projects is hampered by the specificity and a large number of Asian languages.

Comparing fintech in Singapore and Russia, we can say that they have more openness, decision-making processes go a little faster, clouds are more widely used - at least for pilot projects and interaction with contractors. On the other hand, I think that there are more interesting and competent specialists in Russia, and our people are more creative.

I was able to visit and get acquainted with the innovative infrastructure of this amazing country as part of a special tour for VTB, organized by colleagues from Generation S, with whom we are doing a corporate accelerator for startups. In this post, I want to share my impressions of the trip, evaluate Singapore’s FINTECH infrastructure from different angles, tell you how they work with innovations in this country, and generally share the most interesting things about the places I visited.

A bit about Singapore

In 1819, Singapore was a small settlement. It was then that Briton Thomas Stamfold Raffles founded a port there to represent the interests of the British Empire in this region. Therefore, the central square of Singapore is called Raffles Place (Raffles Place). And Singapore became an independent state in 1965.

This is a small country with an area of 722.5 square meters. km with a total population of just over 5 million people. The main population - the Chinese, Malays, Indians. The territory of Singapore is gradually increasing due to the program of the reclamation of territories. The country is highly dependent on external supplies of food and water.

The flight from Moscow to Singapore takes about 11 hours.

Monetary Authority of Singapore

Acquaintance with Singapore's innovations began with a visit to MAS (Monetary Authority of Singapore) - this is a financial regulator, like our Central Bank of the Russian Federation.

MAS building. Source: businesstimes.com.sg

Getting passes to the MAS building is automated. Come to the terminal, scan your passport, enter data and get a temporary pass.

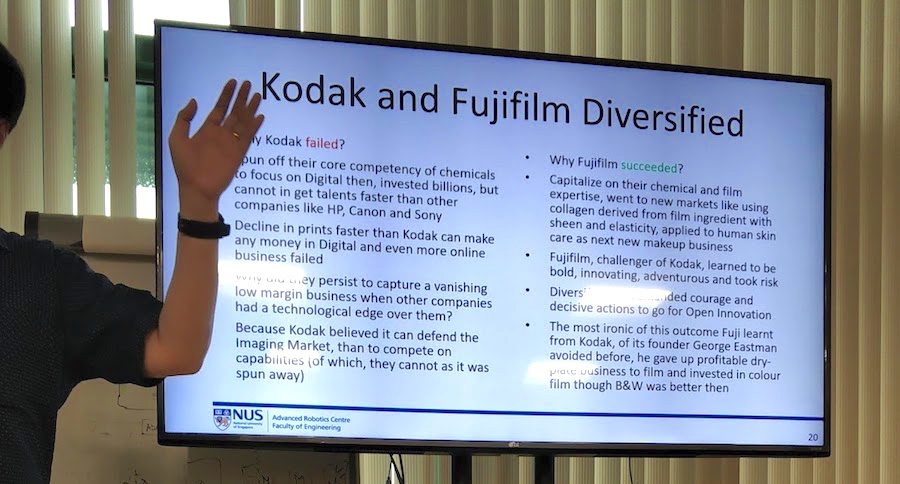

We went up to the floor where the MAS coworking is located - a modern room with a working space and a conference area. There are posters on the walls with the scribing of development trends of fintech and various project ideas.

We were met by Phung Kui Fei - deputy director of the innovative technology laboratory. The purpose of our visit was to find out how fintech in Singapore is regulated, what are the strategic directions of development and the main players here.

Fintech in Singapore

There are few local banks in Singapore:

- DBS Bank Limited

- POSB (Part of DBS Bank)

- OCBC Bank

- Bank of Singapore (part of OCBC)

- United Overseas Bank Limited (UOB)

In addition, there are a number of the world's largest banks, such as Citi, Bank of China, HSBC, JPMorgan Chase, Standard Chartered Bank and others. All this can be clearly seen at ATMs.

The main directions of development of Singapore Fintech:

- blockchain and distributed registries

- big data and artificial intelligence

- Insurtech

- Regtech

- Payments

- Wealth management

- Lending

Of particular interest to the regulator are projects related to artificial intelligence (AI), cybersecurity and distributed registries (DLT).

A list of Singapore fintech companies can be found here . Map by industry - here . The growth of investment in Phintech in Singapore is impressive. Just look at the slides below:

A source

A source

MAS is interested in the development and promotion of the Open API. They even conduct training events for banks to develop the Open API. A list of API and description of methods can be found on the MAS website. Another development priority is cloud technology. The regulator even once made an official statement approving work in cloud services.

MAS has a “sandbox” , but only those whose project is interested in the regulator and who may later need a license are allowed into it. If you do not need a license, then there is no sense for a startup, the Singaporean regulator is convinced.

MAS is also engaged in creating conditions for attracting investments in start-ups. For example, an annual FINTECH festival is held under its auspices. About the festival in 2018 you can read here .

Startup Models

The next item on our list after MAS was the Techstars accelerator, which works in partnership with WeWork coworkings, where startups are placed. TechStars says that large corporations, as a rule, do not understand how to work with startups. Because it is based on a different type of culture. They probably can be trusted - in TechStars, it turns out, they earn more not so much on the accelerator and related activities, but on investments in start-ups. The success of their investments is based on a deep understanding of the culture of innovative entrepreneurship and the availability of networks: a network of teams, a network of experts, a network of investors, etc.

Techstars talked about different models of work with start-ups and innovations:

- Simple competition - competition between startups. In essence, this is a competition for the best solution on a given topic from startups.

- Innovation laboratory - the development of its own expertise and the development of internal and external innovation projects.

- Preaccelerator

- Accelerator

- Corporate Venture Fund

- Internal (spin-offs as the results of internal programs) and external innovative programs

TechStars thinks: the problem of large companies is that they immediately open venture funds, investment funds, accelerators - in general, something big and understandable for them. But this is not the beginning. To understand a startup, you need simpler forms of interaction - you can generally just call startups into your coworking for a joint work session. So you can get to know people, to understand whether it is possible to do a joint business. Then go to the pre-accelerator, then start the accelerator and, finally, open the foundation. And if you immediately start with the fund, it is likely that the company will invest in inappropriate startups, in unpromising processes.

Bank and night club

Innovation is encouraged everywhere. The local DBS bank has a separate division for working with innovations. Their coworking is far from the main office, they live quite autonomously.

DBS is an ambitious bank. When his head decided that they should become number one in Fintech, he set a motivation for innovation in a separate line in the budget - 2%. Innovation awards can be received by any DBS employee.

One day, the head of the DBT fintech lab came to the owner of the local club Zouk. In this, as in any other popular club, there is a problem of queues, when visitors crowd in the queue for cocktails, stand, wait, then crowd again to settle accounts.

DBS offered Zouk a solution to this problem — a chat bot, through which a visitor, if he is a DBS client, can order and pay for a drink. And then just come up and pick it up. DBS did everything for free, with the only condition - it provides all the acquiring. Now this solution works great. And DBS potentially received the entire audience of the club and simultaneously solved its problem.

Such openness to everything new is characteristic of the Singapore business. There you can register a company in two or three days and start working normally. Easy to reach decision makers. Startups are given different concessions, including tax. But pilots, of course, do not open at the moment, you still need about six months to begin work, for example, with a bank. Banks, for their part, are actively providing startups with OpenAPI, letting them into their sandboxes.

Piloting Ripple

We also visited another bank, Standard Chartered Bank. They have a division of SC Ventures, which integrates a laboratory, a program of internal entrepreneurship and the creation of open platforms. On the internal portal of ideas you can describe your idea and get virtual funding from colleagues, which will be converted into real money if the project falls into the top of the best. Also Standard Chartered Bank has its own startup sandbox on Amazon services.

Standard Chartered Bank, like many Western and Asian banks, made a pilot with a distributed Ripple transfer system. One of the features of this system is the presence of a token, or a cryptoactive asset, which allows for interbank transfers. By the way, XRP - Ripple tokens, this is the only private cryptocurrency, which also trades on cryptobirds. At the time of writing the post, XR is the second most capitalized among cryptocurrencies.

However, the problem with the full-scale implementation of such systems is that the accounting department and the treasury do not know how to take such a token into balance. He does not have an appropriate legal status. When (and if) such a status appears, systems like Ripple will significantly change the global financial ecosystem. In the meantime, we are talking only about pilots, where Ripple and similar systems are used only for exchanging financial information messages - that is, only the part that is currently working through SWIFT.

Strong and smart trashcan

We were in the innovation center Vodafone. They are actively promoting the Internet of things, through which data is collected. Interestingly, they use not only 5G-based technologies, but also Lora WAN standards.

We were told about the company's projects and showed various devices. For example, a tool for predicting the maintenance of trains - he predicts when it is time to repair these or other units, nodes. There is a pilot, where Vodafone hangs different sensors on cows to monitor their condition after giving birth, for milk. There are smart trash cans in which trash is pressed. When the trash can is clogged, he sends a signal for a garbage truck to arrive. This allows you to save on logistics. There are all sorts of beacons and similar security devices that Vodafone makes with Black Knight. Vodafone does not lock on its towers and communications stories, they are looking for technological solutions in many areas that Singapore lacks. For example, there are quite a few outdoor cameras in this country, but they are not able to extract and process data from records here.

Empathy for robots

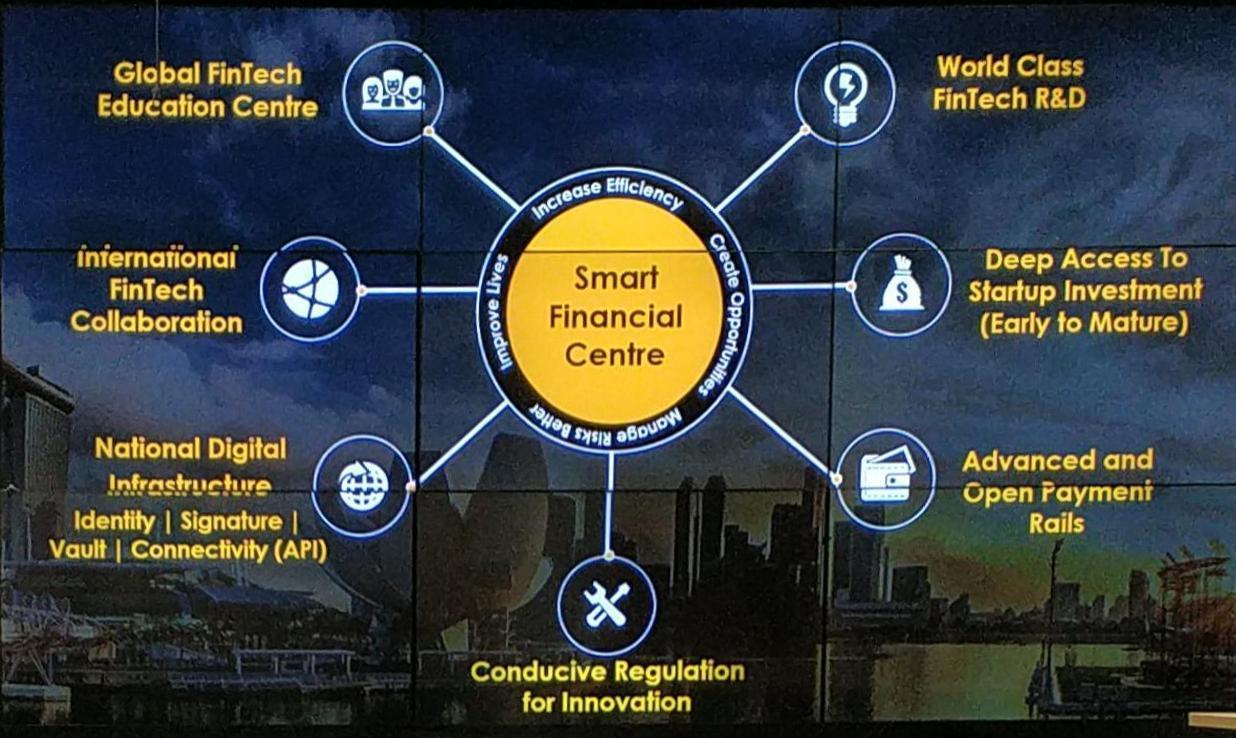

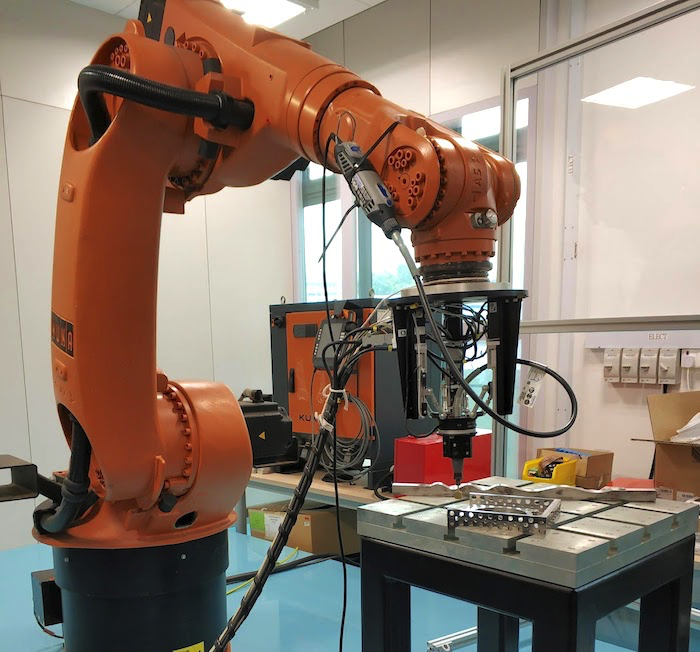

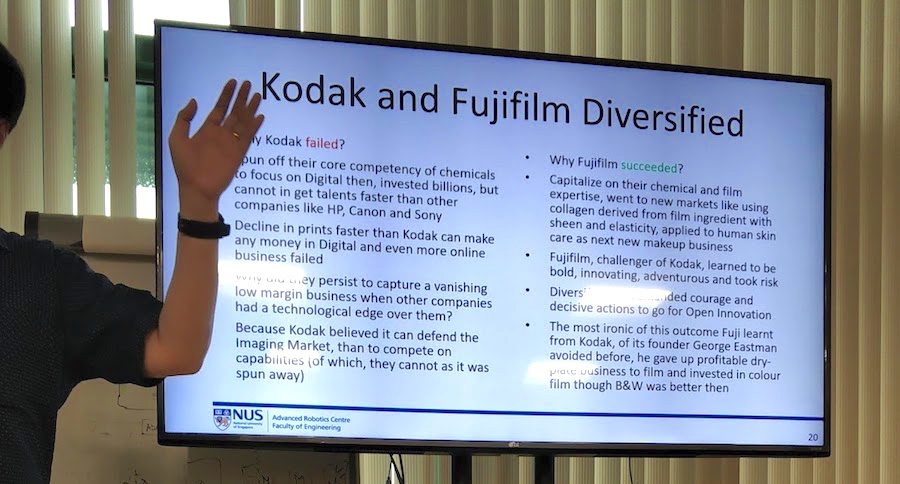

At the National University of Singapore (NUS), we were shown how they work with unmanned vehicles, buses and boats. At the same time, design thinking is being actively used. NUS is convinced that the creation of robots and innovations and anything else begins with empathy - with an understanding of what is around. It is with the help of empathy that you can correctly design cars, including autonomous ones. NUS make a pilot and try to understand how these autonomous cars will move around the city, drive around on the road, who will use such cars. Humanitarian approach.

Also, the university is working on "soft" robots that are designed to manipulate fragile objects.

A professor at the institute said that when start-ups come to the institute, they are told: write 50 reasons why you cannot make your startup. And then go and burn the list. After that, of course, half of startups are not returned to the institute. But if you write and burn 50 reasons every day for three weeks and don’t quit, then the chances of a startup’s success are seriously increasing. The first 30 reasons are usually simple and clear, another 20 are specific. Of course, the reasons can be repeated day after day. A good way to understand what you are ready for, and to show discipline and perseverance. Although he does not guarantee against failure.

Source: fintechnews.ng

Cognitive automation

In addition, we visited TAIGER . The key in the title is the letters AI. This project deals with knowledge cognitive work automation - cognitive knowledge-based automation. It includes three products: iConverce - document validation, iSearch - intelligent adaptive search and iMuch - ontology construction.

Taiger launched a commercial project for document processing. When a whole package of documents comes to you, there is often a need to make sure that the content of the same fields in different places coincides - for example, the name of a legal person. Software from TAIGER highlights such fields and says whether the content matches or not, recognizing text from pictures if necessary. As a result, software based on the existing set of documents already offers a list of things that are worth checking out. Given the low resolution of images in banking scanners, this product looks useful.

The founder of TAIGER is Sinuhe Arroyo, a Spanish mathematician. For nine years he was engaged in AI, more precisely, semantics and ontologies, then he made a project in Spain. Two years ago, he moved the project and part of the development to Singapore to develop business further in Asia. His project is accredited by MAS, he is now actively implemented in banks.

While this language is not supported by this platform. But in Russia there are similar projects - for example, datafabric, which passed to the VTB accelerator.

Finally, we looked at Microsoft. There we were met by a Russian employee, who said that about five thousand Russians were officially registered in Singapore. That the development of AI is very important for administrative purposes. That in Asia you have to be polite, patient and very easy to formulate thoughts. If you keep quiet or hurry, they will think that you are showing off.

AI specialists lack

Of the FINTECH services in Singapore, e-wallets are very popular. At one time, there were many precedents related to infringement of information security, and now the issue of cybersecurity is very relevant for them. In general, Singapore has a large shortage of data scientists and other AI specialists, but at the same time, AI is considered very promising. TAIGER is one of the few projects in this area. The development of such projects is hampered by the specificity and a large number of Asian languages.

Results

Comparing fintech in Singapore and Russia, we can say that they have more openness, decision-making processes go a little faster, clouds are more widely used - at least for pilot projects and interaction with contractors. On the other hand, I think that there are more interesting and competent specialists in Russia, and our people are more creative.

Source: https://habr.com/ru/post/436616/