Why the traditional model of retail stores is already dead

On the example of the US market, the decline of offline retail is noticeable. Many have noticed this in the light of recent news about the closure of Macy's large retail chain with a 160-year history and reports of a loss of $ 34 billion in market capitalization by companies-participants in the retail sector.

The news of Macy's plummeting profits hit an avalanche, and the value of shares in various companies in the retail segment fell by a total of $ 34 billion. Not only Macy's made a mistake in making predictions about making massive profits on holiday sales, relying on high consumer purchasing power. Kohl's, JCPenney and other specialized retailers also reported rather mediocre results of the holiday discount season. And the results of this period are considered to be a key indicator of success for the sector.

Around this time, another significant event happened: the second oldest retailer in the United States, Sears, announced its closure.

Analysts who consider Macy's to be a trendsetter for the American middle class explain the company's failures with unexpected price spikes in prices that were observed several weeks before Christmas and a fire in the company's distribution center, which analysts say has affected the product mix.

Both of these factors played a certain role, but they are not so significant against the background of the really important problems that Macy's and other traditional physical retailers have faced, which in recent years have been trying to convince the world that their usual trading model is firmly on its feet.

The fall of physical retail

The traditional model of physical stores, if not dead, is exactly in reanimation. The diagnosis is quite simple: retailers did not see a forest of digital opportunities behind the store trading trees.

This was largely due to the fact that retailers, based on incorrect data, made incorrect assumptions about current consumer habits. Many believed the erroneous analysis and could not understand the obvious. To save physical retail, any retail store owner needs to convince consumers that going to these stores is really worth the time spent.

And this is not an easy task.

And all because over the past few years, consumers have realized that going to the store is a much less productive process compared to shopping online, no matter which online stores you are talking about in comparison.

Trap hidden in the data

The idea of a vibrant and flourishing traditional retail is still popular today. In the end, 90% of all sales take place at physical locations.

At the same time, there are constantly news about a steady annual outflow of visitors from stores. Since 2017, 11 thousand real trading floors have closed in the USA. Statistics show that more than 18 million square meters of space in malls and on main city streets remain unclaimed.

The myth of the greatness of physical retail is reinforced by an incorrect interpretation of statistical data. This story is fueled by incorrectly compiled official statistics and attempts to give what is desired. One side of the problem is that the available Census Bureau data do not seem to be very reliable. On the other hand, the Bureau does not share all the information that it does have. And thus, it becomes impossible to determine the real situation in retail.

Most confusing is the emphasis on the average percentage of all online retail sales and ignoring key verticals. Such an approach is comparable with the statement that on average there is no canary in all coal mines, and therefore there is no danger for the miners. Even if in the most important of the mines there are canaries.

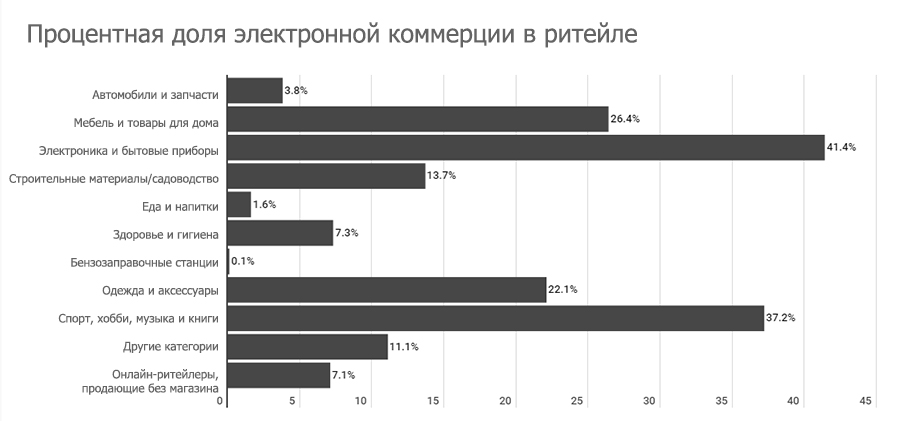

Below are the indicators that the PYMNTS analytical group obtained by comparing data from the Census Bureau and other sources, and building their own model based on them. Analysts say that stores selling clothing, sports goods and electronics cannot confirm that 90% of retail sales still occur in their premises, if they occur at all.

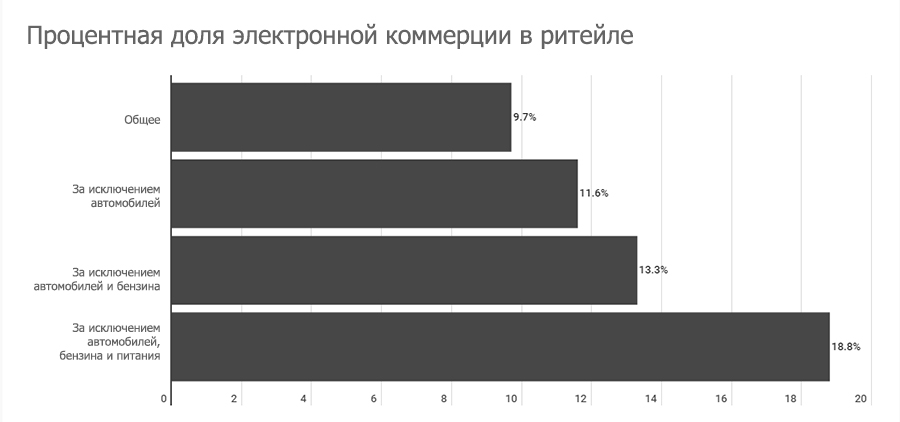

And below - the position of the Census Bureau. If we exclude statistics on cars, restaurants and gasoline, as PYMNTS did, it turns out that about 80%, and not 90% of all retail sales occur in physical stores.

You do not need to be an analyst and build complex information models to understand that people began to buy less in physical stores than ever before. It was enough for the last four years to visit physical outlets and communicate with their staff.

Mobile applications and logistics innovations have significantly improved online shopping practices. But the in-store experience has become less reliable. Consumers, who call time the most valuable resource, want the buying process to be convenient and free from any uncertainties. Trips to the physical store do not always meet these two requirements.

Therefore, people prefer to buy online those things that were once more convenient to buy only in physical retail - clothes, jewelry, sports goods, electronics. Increasingly, this also includes home goods and car parts.

Consumers further increased the gap between physical and digital shopping.

The PYMNTS study last fall, in which 2,600 people took part, confirmed this thesis for at least two categories of goods in which physical retail would seem to have an undeniable advantage: clothing and cosmetics. After all, it is assumed that the opportunity to personally touch and try samples of goods gives real stores a tangible advantage.

However, only 42% and 34% of consumers who bought clothes or cosmetics, respectively, reported that they purchased the goods in a physical store.

Similar trends analysts observed in the recent holiday sales season.

A survey of 1000 consumers, conducted by PYMNTS the day after Black Friday in 2018, showed that 40% of consumers who took part in this event made orders from home. The remaining 60% went to the store for one reason: they were convinced that they would be able to grab some incredible discount.

The sample included adult representatives of all American social groups. According to the respondents, physical stores were in third place on their list of preferred shopping channels. The first place in these or other categories is occupied by home PCs or mobile devices.

Guessing on the retail thick

Amazon has long earned a reputation as a dreadful scarecrow for physical retail. This online monster is almost twenty years on a short leg on Wall Street and does not report profits. A company can afford the luxury of financing its own retail business and Prime programs at the expense of its other businesses, such as the AWS cloud service.

Probably in every sad story there must be a villain. But we can not forget about the other.

Amazon was founded in 1994, when almost all retail existed only in physical stores. At the very beginning of the journey, Amazon did not have a single client, nobody knew about the company, and their website was awful and inconvenient by modern standards.

The company sold only one type of goods - books. And she did it through the channel, not at all conducive to the experience of digital shopping. In 1995 , when Amazon launched and sold the first book, the most popular web pages gained no more than 20-30 thousand visits per week. Only 14% of the US population then had access to the network.

Then only 42% of Americans knew about the existence of the World Wide Web. The most popular way to access it was a telephone modem, which people used to access AOL. Those who want to walk through the pages of history can listen to very specific sounds that the modem made when connecting to the network. Modern websites would take an average of two and a half minutes if a dial-up connection had been used so far.

This can hardly be called a pleasant user experience.

The broadband connection spread only 12 years later, in 2007. Then it was recorded that this type of access appeared in half of Americans. Another 7 years later, in 2014, again, half of the country's population acquired smartphones.

It is not surprising that retail treated the digital world and online shopping as a small and insignificant part of consumer experience.

But far-sighted innovators assumed that the situation in the digital world would improve, and that more and more users in the future would have access to broadband and mobile Internet. And the more people start using the Internet, the higher the demand for new mobile devices and fast communications. This, in turn, will spur interest in digital commerce. Such spiraling development will gradually erase the line between the physical and digital worlds.

Payment innovators believed in the mobile digital future and began to invest in eliminating difficulties in making online purchases. They knew that the growth in the number of applications with effective integration of payments would contribute to the sales of smartphones, and the circle of useful digital innovations would close.

Between 2007 and 2014, Amazon's retail sales revenue experienced explosive growth, turning the company into an e-commerce leader. Sears ceased to exist then ranked fifth, and Macy's - eighth. The online sales of both retailers grew, but were insignificant compared to the sales generated by the flow of visitors to their physical stores.

Unfortunately, Amazon’s explosive growth went unnoticed against the background of physical retail earnings, and the impact of digital and mobile technologies was not adequately evaluated.

At the end of Q4 2014, the US Census Bureau reported that online sales account for approximately 6.5% of total retail sales, or 308 billion dollars, and a year earlier, the figure was 5.8%. An analysis of materials from those years reveals quite a few reports that online sales account for only a few percent of traditional retail sales, that they are overvalued, and talk of the death of physical retail is nothing more than hysteria.

It's hard to believe that this was just four years ago.

The big paradox of physical retail

Over the past few years, retailers have spent hundreds of millions of dollars trying to lure consumers into their stores. They organized demonstrations of fashionable clothes, called experts for the presentations of new products, arranged with stars and famous athletes to represent brands, and set up special mirrors to make fitting of clothes more comfortable. They gave the sales staff tablets with recommendations, combinations of products or tips on the use of certain products. They offered discounts and promotions that are valid only when visiting physical outlets.

Next in line are robots who greet customers at the doorstep of the store and help them find the right products. Perhaps there is an application of AR and VR-technologies.

Only time will tell if it is not too late for traditional retailers to get down to business.

Physical retail has now embarked on the same journey as Amazon and other online retailers 20 years ago. But with one big difference. Despite the fact that digital trends are moving in the same direction, there are fewer factors contributing to development in this direction.

The transition from offline to online occurred fairly quickly, given that consumers in this sector spend 4.2 trillion dollars. In 2008, when the iPhone was introduced, and the mobile digital revolution really began, the Census Bureau reported that the share of traditional retail sales was 97%.

While retailers, as well as their analysts and consultants tried to guess at the coffee grounds of the bureaus, thinking that e-commerce would become relevant only after 20, 30 or 40 years, consumers were switching to mobile and digital channels for shopping.

People began to get used to the certainty and convenience of online search for desired products and the ability to get them when they want. At the same time, buyers were weaning off uncomfortable and uncertain shopping trips.

In stores there is no longer that variety of the assortment that was observed before. And offline purchase does not allow to get the goods faster than if he was ordered from home.

Shopping trips to find something interesting have ceased to be fascinating, since even on holidays there are few buyers and limited choice.

Services of sales assistants in real stores are either not very useful or excessively intrusive due to the small number of visitors. But at the same time, sellers lack a complete understanding of the consumer’s purchase history to make the selection process as productive as possible.

Lack of assortment and shopping atmosphere makes physical stores in a boring place. And this downward spiral of negative experience only contributes to the decline.

Changes will benefit the outlets

To change consumer thinking, retailers first need to reconsider their attitude to the role of physical stores in the lives of customers.

Investing in “ click and take ” schemes is one of the options. But there is no guarantee that consumers will additionally buy something or even cross the threshold of the store. The convenience of schemes in which people pick up goods near the store, lies precisely in the fact that such decisions put consumer interests in the first place, and only secondarily they try to lure him into the store to continue shopping.

A few years ago, analysts expressed the opinion that the future of physical retail as a category and physical stores as points of interaction with consumers will be similar to the evolution in the media sphere: only the most large-scale or narrow niche projects will survive.

The largest retailers will be able to take advantage of their branching to provide a range and efficient logistics. This will satisfy the needs of consumers across all channels, including digital.

Niche players like local ateliers or designer brands offering a combination of a unique range and exceptional service will also enjoy steady demand, since the experience they provide is very different from the mainstream.

And all that is somewhere between, does not stand out and does not differ, will become useless and will die.

Innovation helps consumers pre-order through Internet devices and avoid queuing. The combination of new solutions with in-store technologies has already changed the attitude of users to what a modern physical store should be.

Physical retail is really alive. Look at least on Amazon Go . But the physical retail of the future will pass the road of modern media: there will be only players who have adopted new technologies, and business models offering a new look at the usual processes.

Source: https://habr.com/ru/post/437292/