What happened to SSD in 2018

Last year in the history of SSD was the most interesting since when these devices went into mass consumption. Increased competition and decreased prices. Existing technologies, such as 3D NAND and NVMe, showed their full potential, and new technologists, such as QLC NAND, took a good start.

3D NAND shows everything they can do with 64 layers

2018 was the first full year when major NAND flash memory manufacturers massively manufactured 3D NAND with 64 layers or more. 64-layer 3D TLC, which are produced jointly by Intel / Micron and Toshiba / SanDisk / Western Digital, performed well in competition with Samsung's memory, which for the first time equalized the chances of the largest suppliers.

Intel and Micron were the second after Samsung to release 3D NAND, but their first 32-layer generation was obviously slow and was clearly not ready to challenge Samsung’s V-NAND, although it was good enough to be mass produced. But the second generation has not just doubled the number of layers: speed and energy efficiency have increased significantly.

Meanwhile, Toshiba and Western Digital / SanDisk did not release products based on the first generation of 3D NAND, and the second generation released as a niche product. But the third generation of 64-layer BiCS 3D NAND has prepared for the fight. SK Hynix tried to overtake the rest of the market by the number of layers (now they have 72), but this was not enough, and their NAND is rarely used in SSD, except for their own models . It is easier to find in memory cards, USB-flash drives and smartphones.

Thanks to active production and serious competition, NAND prices in 2018 began to fall. They are expected to fall further in early 2019, despite the manufacturers' plans to slow production down or stop its expansion. All modern ready-made storage schemes from manufacturers of SSD controllers are designed for 3D NAND and the transition from flat NAND has been completed in all product segments and all brands.

On average, SSD prices fell faster than in any of the previous years, and all the price increases caused by shortages during the transition to 3D NAND have already disappeared. SATA SSD entry level without DRAM costs already from $ 20 for 120 GB, and drives with a volume of 1 TB are already approaching $ 100. SATA drives for mass use from popular brands are the most expensive by 30-40%, which means that they will pass the 10-cent mark for 1 GB in 2019. Lower prices mean an increase in consumer SSD options of 2 TB, even before the widespread adoption of QLC NAND technology. So far, Samsung is just beginning to try to sell its 4 TB SSDs in the consumer market, but in 2019 the situation will have to change.

NVMe has ceased to be a game field only for Samsung

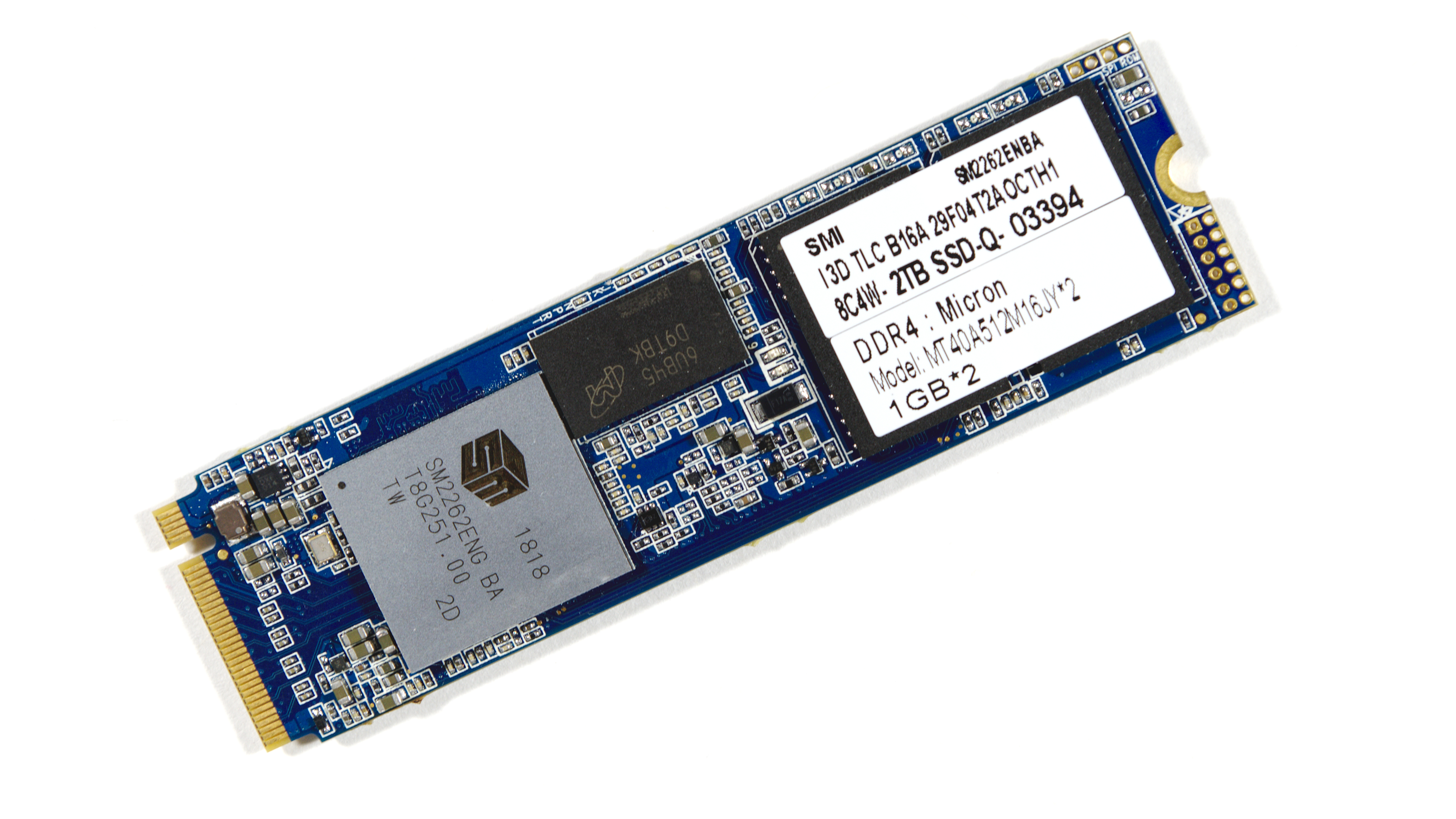

In 2018, the consumer market of NVMe SSD significantly increased, which was facilitated by the release of several new controllers that challenged Samsung’s dominance in this area. Western Digital introduced its first own controller with the second generation of WD Black and its OEM copies . Along with the transition from the flat 15 nm TLC to the 64-layer 3D TLC, WD Black produced the most significant improvements from all that we saw in the SSd product line. However, this did not become the biggest shock to the market. Silicon Motion and Phison have given out new generations of NVMe controllers, and their flagship chips are also able to challenge Samsung controllers. For the first time, SSD brands using ready-made drive schemes were able to compete in this market, and drives such as the HP EX920 and ADATA SX8200 became the best option for high-end consumer demands. There are very few brands that do not offer a competitor for them.

The new generation of NVMe SSD controllers also offers a wider range of entry-level NVMe SSD options, including DRAMless NVMe drives using the NVMe Host Memory Buffer option to help avoid the worst effects of the DRAMless scheme. However, the entry-level NVMe SSD is still much more expensive than the common SATA SSD, and the higher-class NVMe SSD is not particularly expensive than the usual ones, so this segment does not have much value yet. Perhaps this is partly due to the speed of prices falling on the SSD market: the more popular NVMe high-end drives become cheaper faster than entry-level NVMe, so these segments intersect at prices more strongly than if prices were more stable.

High-end consumer NVMe SSDs provide consistent read speeds over 3 Gb / s, so we are approaching PCIe speed limits of 3 x4. PCIe 4.0 is still far from entering the consumer market, so we can expect a period of a year or two, when the NVMe market will be as slow as the SATA market. However, NVMe SSD still has room to strive for in terms of random IO and energy efficiency (which usually falls short of SATA SSD).

QLC NAND Arrival

After several years of chatter, in 2018 QLC NAND flash memory finally entered the market. QLC NAND stores four bits per memory cell instead of three bits in TLC NAND, which gives a good increase in storage density and reduces the cost per unit of memory. Difficulty in distinguishing 16 different voltage levels in a single memory cell leads to serious flaws in speed and endurance on writing, but they are not as bad as they were several years ago: most of the QLC SSD guarantees about 0.1 disk records per day for five years [Drive Writes Per Day, DWPD - a measure of endurance SSD; this is the permissible number of rewriting cycles of the entire disk per day during the warranty period / approx. transl.] - this is three times less than that of today's low-cost TLC SSD. And this is already enough to use QLC NAND as a general purpose drive, not trying to use it as a drive for the “one write many reads” class [write-once, read-many, WORM] using special software and file systems.

Intel and Micron were the first to announce the release of the QLC NAND SSD, starting with the Micron 5210 ION SATA SSD. Both companies released custom NVMe SSDs with QLC NAND in the fall, using the SM2263 entry-level controller from Silicon Motion. Intel's first NVMe SSD was also a QLC drive. Samsung's first QLC NAND product was a consumer 860 QVO SATA SSD . Toshiba and Western Digital (SanDisk) have not yet announced the release of the QLC SSD, and most likely are waiting for the second-generation QLC based on 96-layer 3D NAND.

In the professional drive market, the role of QLC NAND is clear: kill hard drives with a rotational speed of 10 K RPM and start competing with 7200 RPM drives. In the consumer market, the situation is more complicated. With a large SLC cache, such QLC SSDs with NVMe as the Intel 660p and Crucial P1 can offer greater speed, but with some reservations. But QLCs may become more popular in the SATA SSD market as an alternative to DRAMless TLC SSDs in their quest for a goal of 10 cents per GB.

QLC NAND is still in the bud, and its growth will be one of the main trends in 2019. So far, it’s unlikely that QLC NAND could have a significant impact on TLC NAND sales in the near future; most likely, it will simply contribute to the growth of the SSD market. There are still doubts about whether QLC is worth it to deal with its problems, especially given the fact that the cost per gigabyte of QLC NAND is almost the same as the cost for TLC NAND.

New form factors for professional SSD

Several major players in the SSD market are participating in the format warfare regarding the future form of SSD in data centers. The M.2 SSDs turned out to be too small and limited in capabilities due to the 3.3 V power supply and the lack of hot-swappable options. The 2.5 "U.2 SSD can be changed on the fly, but it is hard to cool, especially when using paired cards to increase the capacity of drives with dozens of NAND chips. In the first round of new offers from Intel Ruler and Samsung NF1. Ruler has standardized in EDSFF, but it has on a huge number of options. NF1 is not using any standards organization yet, and this option has already incurred the wrath of the PCI SIG because of the reuse of connector M.2, which conflicts with its plans for M.2, but Samsung has already agreed c several partners developing NF1 SSD or enclosures for them.

So far, the outcome of the format war is not clear, but many companies do not stop it, and they are moving forward with their development and implementation. These new form factors will probably never appear on the consumer market, and their early users will be large companies that are not dependent on market trends and, thanks to their volumes, are able to order SSDs in any form factor.

Rest in Peace, IM Flash Technologies, 2006-2019

In 2018, Intel and Micron decided to end their long-standing flash memory partnership. IM Flash Technologies (IMFT) was formed in 2006 shortly after the SSD began to gain popularity, and was one of the main players throughout the history of the market. IMFT was the second NAND vendor to bring 3D NAND to market, and its 3D XPoint memory development spurred its competitors to release other low-latency memory types, including the Samsung Z-NAND and, later, Toshiba XL-Flash.

This break of relations seriously changes the competitive landscape of the solid-state memory industry, but it will not happen instantly: it will pass in several phases. The two companies have already transferred the production of NAND flash each to their factories, however, development and research remain a common cause, and are conducted in the IMFT office in Lehigh, Utah. At the beginning of 2018, Intel and Micron announced that they would start developing and researching separately after they finished the 96-layer memory generation, which should appear on the market in 2019. A few months later, a 3D XPoint development division was announced, which will occur after the completion of the development of the second generation of 3D XPoint in the first half of 2019. Micron buys Intel’s stake in Lehigh’s factory, where 3D XPoint is produced, so Intel will have to buy substrates from Micron until the company starts production in one of its laboratories.

The development of new memory in Intel and Micron, probably will go in very different ways. Intel is likely to focus on industrial drives, and they are working on a strategy dividing products between 3D XPoint, providing performance, and QLC NAND, providing volume. Intel may become the first NAND manufacturer to abandon TLC, but only if it succeeds in making the 3D XPoint much more affordable than the first generation. Micron's business in the NAND field is much broader: it is the main supplier of consumer and industrial SSDs of its own manufacture, and its NAND is used in the products of other SSD brands, as well as in the mobile, industrial and embedded electronics markets. Micron's plans for 3D XPoint are not yet known. They did not release products with the first generation of 3D XPoint, and in the long run they may plan to shift attention to a completely different type of non-volatile memory that no one else will have.

New competitor on the horizon: Yangtze Memory Technologies Co.

China’s Tsinghua Holding has a subsidiary of Yangtze Memory Technologies Co. (YMTC) trying to break into the 3D NAND market. Since she was late, her development plan seriously lags behind competitors, and she needs to go through several technological stages very quickly in order to catch up with those ahead. In 2017, they developed a 32-layer 3D NAND, and are now working on a 64-layer 3D NAND, which should hit the market in 2019. After that, they want to jump over 96 layers and immediately go to 128 in 2020 to catch up to older players. The key difference between NAND and YMTC is the new production method, which the company called Xtacking : instead of having peripheral auxiliary circuits under the flash memory array (as Intel and Micron first did, and then planned everything else for themselves), YMTC produces two parts of the chip on separate substrates. She claims to be able to combine the finished peripheral substrate and the substrate with an array in one production step. Her first 64-layer 3D NAND is the first technology demonstration.

Besides the fact that such a process allows you to make a matrix of small size, it will give YMTC a few more advantages that will allow the company to catch up with competitors. By manufacturing peripherals and memory arrays separately, YMTC can separate the development of these two schemes and move faster. Also, the peripheral circuits can be made using the traditional logic process instead of the memory manufacturing process - at the moment they use a well-developed and therefore cheap logic process at 180 nm. YMTC plans to make the main feature of its memory extremely high IO-speed, using several planes per matrix. She hopes to reach speeds of 3 Gb / s from one matrix, while other players in the market are just beginning to break the 1 Gb / s bar.

Source: https://habr.com/ru/post/437356/