Telegram sells cryptocurrency at $ 1.33 per 1 gram, applications for less than $ 1 million are not considered

Pavel Durov at a reception in honor of the 20th anniversary of Megafon in St. Petersburg in the summer of 2013. Photo: RIA News, Valery Levitin

Two weeks ago it became officially known that the company Telegram Group Inc. and TON Issuer Inc. (both registered in the British Virgin Islands) attracted $ 850 million from 81 investors in a private placement of securities. This figure was published in the reporting of companies before the US Securities and Exchange Commission (SEC). At the same time, there is information that the demand for paper has far exceeded the supply: applications came in at $ 3.8 billion .

Experts were amazed at the huge amount of attracted investments. For comparison, in June 2017, the gold holding Polyus raised $ 799 million, and Metalloinvest in July earned about $ 400 million by placing the Norilsk Nickel ADR.

The sale of Telegram securities has raised more money than the IPO of almost all Russian companies in recent years. And it is also a world record in ICO size - not a single foreign startup has ever come close to such amounts. Although the placement of Telegram is not an ICO in the full sense: the securities are sold for Fiat, and not for Ether.

And not everyone can participate in the process. Telegram sends out personal invitations to selected venture funds and individuals, which are selected according to some of their criteria. It is said that David Yakobashvili ($ 10 million), founder of Qiwi Sergey Solonin ($ 17 million), and also good Abbess of Pavel Durov - Roman Abramovich ($ 300 million) are among the investors of the first round - the founder of Wimm-Bill-Dann. The Financial Times newspaper wrote that the securities are going to buy the main funds of Silicon Valley - Kleiner Perkins Caufield & Byers (early investor of Google and Amazon), Benchmark (investor of Uber and Twitter) and Sequoia Capital (early investor of Apple and Google).

Surprisingly, Telegram is not going to stop at this. Several sources from among the investors of the first round told Vedomosti that a second round was being prepared. In the explanation to the application for investors, it is stated that in the second round Telegram expects to raise up to $ 1.7 billion. Thus, a total of $ 2.55 billion will be invested in the new cryptocurrency.

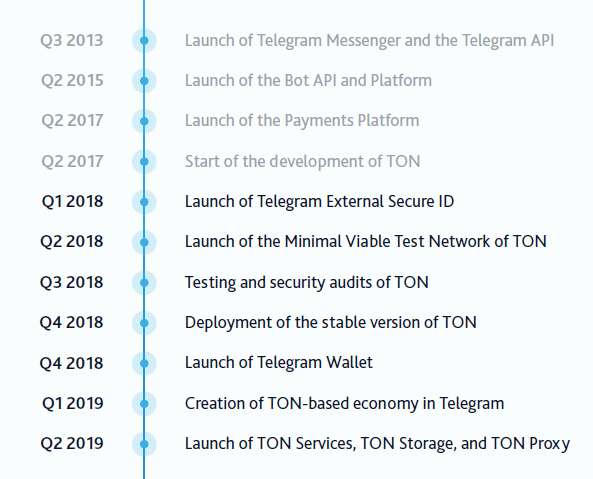

White paper for investors of the first round (pdf) , mirror

As described in white paper for investors, Telegram intends to release its own cryptocurrency Gram (gram) and blockgram-platform Telegram Open Network (TON). By purchasing the securities of companies, investors receive the rights to the cryptocurrency of the Grams project, which will be released after the launch of the TON blockchain platform. According to the plan, they want to launch its platform before the end of 2018. If the platform is not launched before October 31, 2019, Telegram promises investors to return the money, although it warns that there are no guarantees.

Like last time, a new round of financing is again held in a closed format. It is divided into two phases A and B, the first of which is scheduled for the end of February and seems to have already begun. Individuals can buy “grams” for at least $ 1 million, legal entities - for $ 10 million.

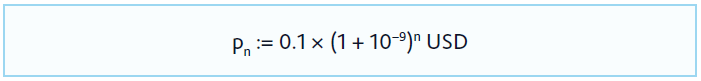

The document says that investors will sell up to 1.05 billion TON (grams) tokens. The total number of native tokens is 5 billion, 4% of them will remain to developers, 52% are in reserve, and 44% will be sold to investors. The price formula (p) for each nth token is listed on page 16 of the official prospectus:

At the first stage of the second round, the price of tokens is $ 1.33 per gram. This price is four times (!) Higher than at the first stage, when $ 0.38 was taken for 1 gram. Other sources say that the cost of 1 gram has now grown to $ 1.5.

True, the conditions for the purchase of new “grams” have changed. Participants of the first round subscribed to the lock-in restriction. Under the terms of the agreement, the grams in their wallets are frozen for 18 months from the launch of the TON blockchain, and then 25% are released after three months, another 25% after nine months, and so on.

Investors at the second stage have no such restriction - and they can sell their grams as soon as they begin to be quoted on international exchanges. Or sell on the over-the-counter market at a negotiated rate. The price of tokens, the plan for attracting investments and other parameters of stage B of the second round are not described in documents precisely.

Investors are invited to finance through the venture funds iTechCapital and Da Vinci Capital. According to documents submitted to RBC , Da Vinci Capital intends to register a separate structure on the Cayman Islands - DVC TON Fund. This fund will accept payments in dollars from investors and then transfer funds to the legal entity that will sell the tokens - the “tokenizer”.

DaVinci Capital managing partner Oleg Zhelezko declined to comment, as did iTech Capital partner Gleb Davidyuk. Apparently, the sale of grams through a tokenizer in the Cayman Islands hardly fits into Russian legislation.

There is a possibility that Telegram is not going to hold an open standard ICO in a standard format for everyone.

Why do investors invest in ICO, if most of them are statistically bankrupt? For the same reason why they invest in startups. If at least one of ten startups "shoots" - then the losses from all unsuccessful investments pay off. For example, in October 2017, the venture capital firm Mangrove Capital Partners conducted a blind test of the ICO market - invested a virtual 10 thousand in 204 ICO, selected at random . Although many projects failed, but the total portfolio value for the year increased by 13.2 times (although there is one reservation: the cost of Ether cryptocurrency increased 40 times over this period - from $ 8 to $ 320, that is, it was more profitable not to invest at all coins).

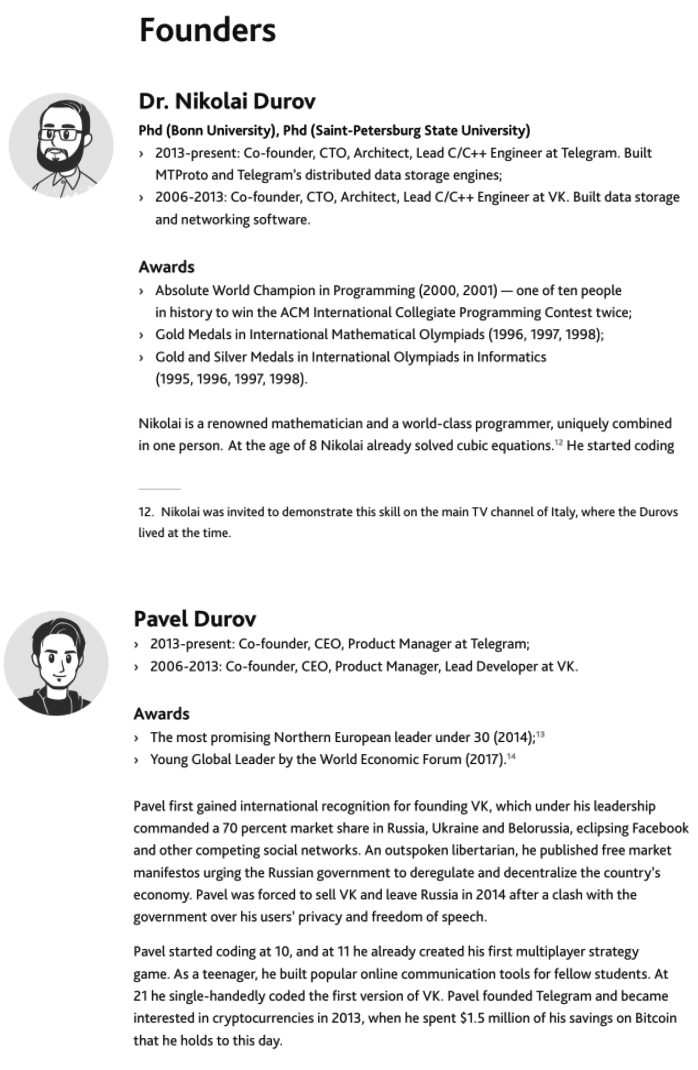

PS The official prospectus contains an interesting biographical information about the two founders of the company (screenshot below). For example, it highlights one of the achievements of Pavel Durov - in 2013, he bought bitcoins for $ 1.5 million and still stores them (HODL). And his elder brother Nicholas, being sent by an 11-year-old child to Siberia without access to a computer, used up hundreds of pages in x86 assembly code.

Source: https://habr.com/ru/post/410507/